Top 5 Financial Reports Every Business Owner Should Understand

Top 5 Financial Reports Every Business Owner Should Understand

As a business owner, understanding your company's financial health is crucial for making informed decisions and driving growth. Financial reports provide valuable insights into various aspects of your business, from profitability to cash flow. However, with so many reports available, it can be overwhelming to know which ones to focus on. In this article, we’ll explore the top 5 financial reports that every business owner should understand to manage their business more effectively.

1. Income Statement (Profit and Loss Statement)

The Income Statement, also known as the Profit and Loss Statement, is one of the most important financial reports for any business. It shows your revenue, expenses, and profits over a specific period (monthly, quarterly, or annually).

- Why It Matters: The income statement allows you to see whether your business is making a profit or loss. It highlights where your revenue is coming from and how much is being spent on various costs, such as rent, payroll, or marketing. This report helps you track your business’s financial performance and can assist in identifying areas where you may need to cut costs or increase revenue.

- Key Components:

- Revenue: Total earnings from sales or services.

- Cost of Goods Sold (COGS): Direct costs related to producing goods or services.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Ongoing costs such as rent, salaries, and utilities.

- Net Profit: The bottom line—your profit after all expenses have been deducted.

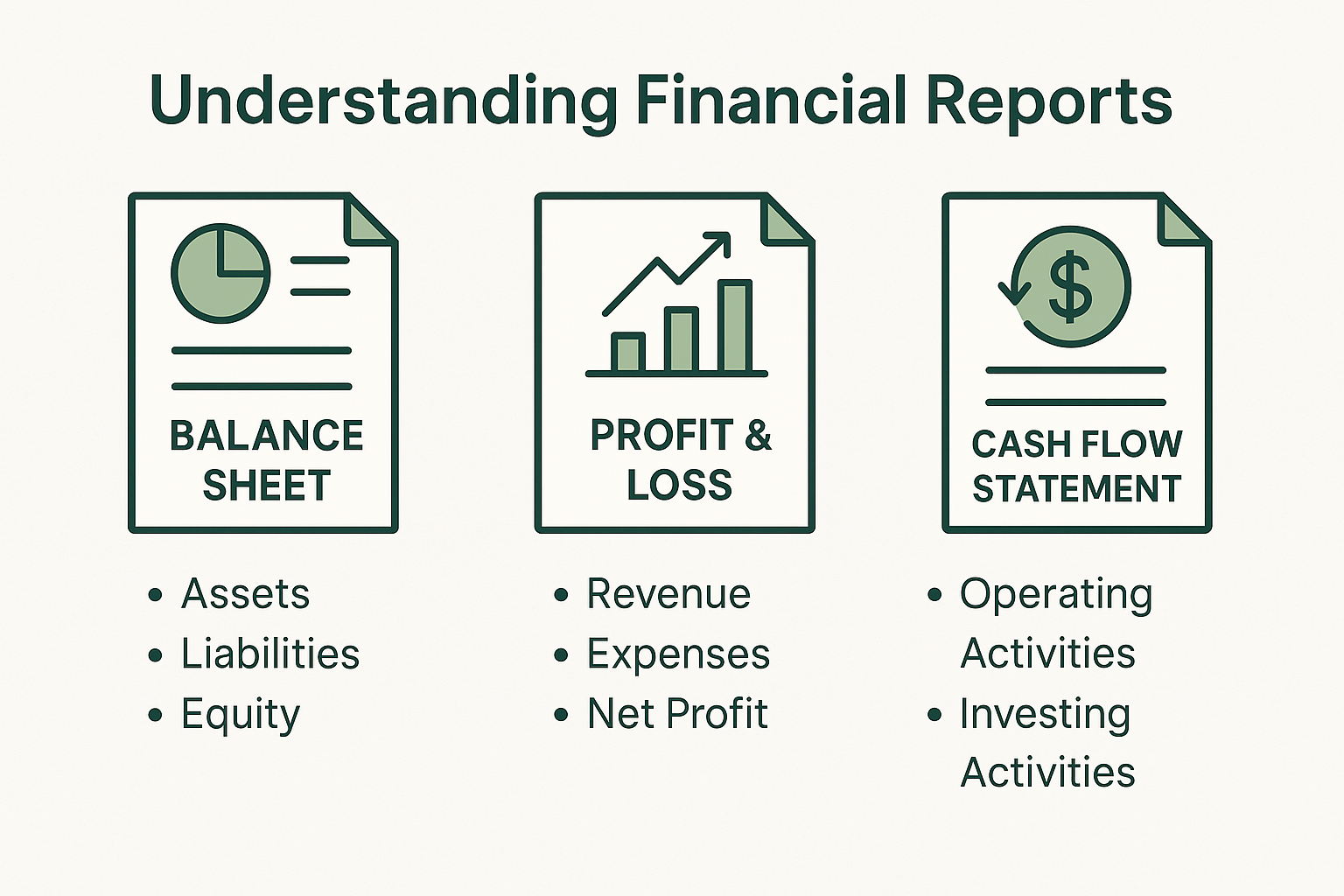

2. Balance Sheet

The Balance Sheet provides a snapshot of your business’s financial position at a specific point in time. It shows what your business owns (assets), what it owes (liabilities), and the equity invested by the owner(s).

- Why It Matters: This report helps you understand the overall financial strength of your business. It shows whether your business has enough assets to cover its liabilities and gives you insight into your business’s liquidity and solvency. The balance sheet is also critical when applying for loans or attracting investors, as it demonstrates your company’s financial stability.

- Key Components:

- Assets: What your business owns (cash, inventory, equipment, etc.).

- Liabilities: What your business owes (loans, accounts payable, etc.).

- Equity: The value remaining after liabilities are subtracted from assets, representing the owners’ stake in the company.

3. Cash Flow Statement

The Cash Flow Statement tracks the movement of cash in and out of your business over a period of time. It shows how cash is generated from operations, investments, and financing activities and how it is being spent.

- Why It Matters: Even profitable businesses can run into trouble if they don’t manage cash flow properly. This report helps you monitor your company’s liquidity and ensures you have enough cash on hand to cover expenses like payroll, rent, and other operational costs. The cash flow statement can alert you to potential cash shortages before they become a problem.

- Key Components:

- Operating Activities: Cash generated or used in the normal course of business (sales, payments to suppliers, etc.).

- Investing Activities: Cash used for purchasing or selling assets (equipment, property, etc.).

- Financing Activities: Cash from loans, investors, or dividends.

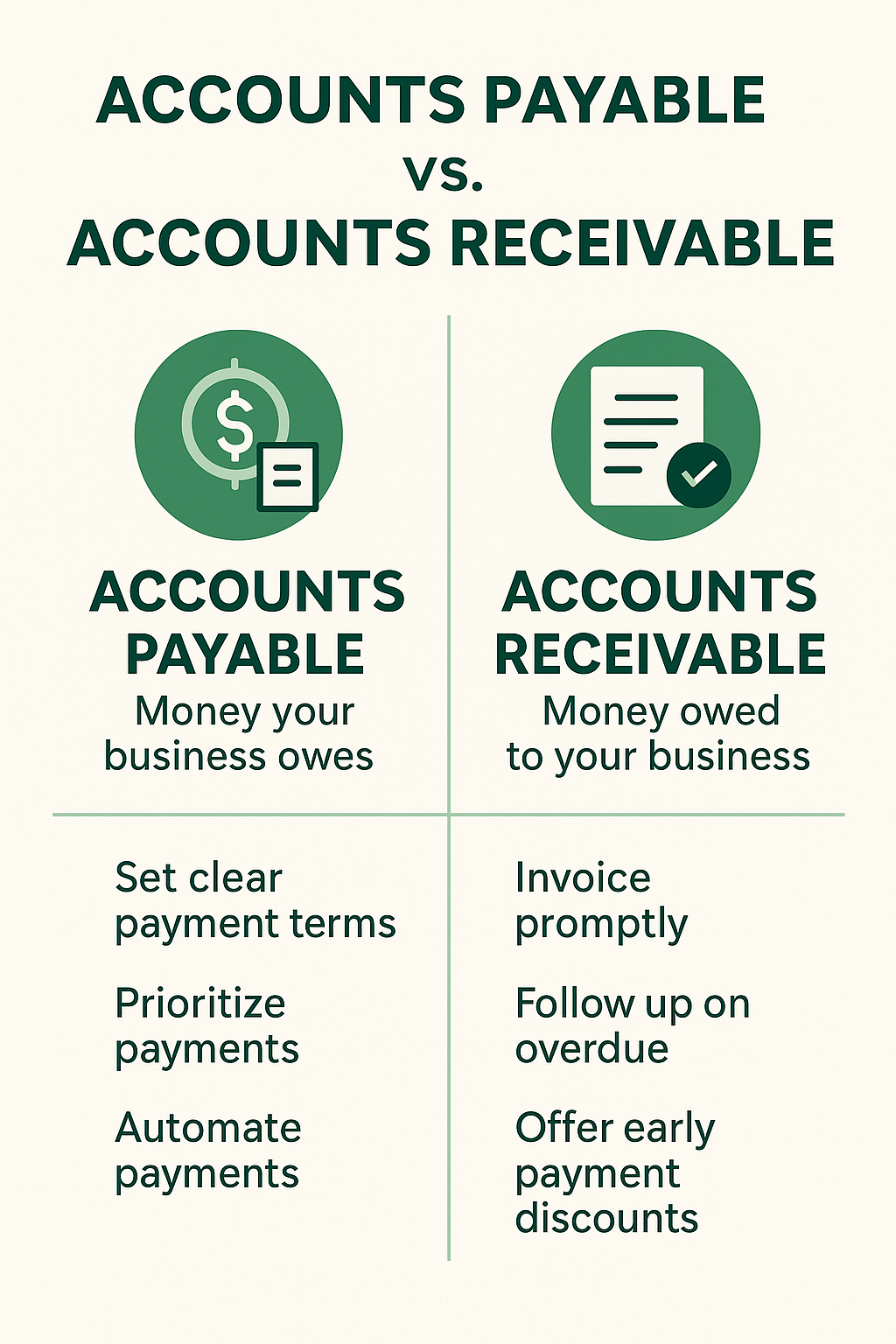

4. Accounts Receivable Aging Report

The Accounts Receivable Aging Report is a detailed list of all the outstanding invoices owed to your business, categorized by how long the payments have been overdue.

- Why It Matters: This report is crucial for maintaining healthy cash flow. It helps you track which customers owe you money and how long their payments have been outstanding. By keeping an eye on this report, you can identify late payments and follow up with clients, helping you collect overdue invoices and avoid cash flow problems.

- Key Components:

- Customer Names: A list of clients who owe you money.

- Invoice Amounts: The total amount due from each client.

- Aging Categories: Breaks down invoices by how overdue they are (30 days, 60 days, 90+ days).

5. Budget vs. Actual Report

The Budget vs. Actual Report compares your actual financial performance to your budgeted figures for a specific period. It shows how your income and expenses stack up against what you had planned.

- Why It Matters: This report allows you to see whether your business is on track with its financial goals. It helps you identify areas where you’re overspending or underperforming, so you can adjust your strategy as needed. By reviewing this report regularly, you can stay within budget and make more accurate forecasts for future periods.

- Key Components:

- Budgeted Revenue and Expenses: The amounts you planned for income and costs.

- Actual Revenue and Expenses: What you actually earned and spent.

- Variance: The difference between budgeted and actual figures, helping you spot discrepancies.

Conclusion

Understanding these five financial reports is essential for managing your business’s financial health and making informed decisions. Whether you’re tracking profitability, managing cash flow, or comparing your performance to your budget, these reports provide valuable insights that can drive growth and help you avoid financial pitfalls.

If you’re unfamiliar with generating or analyzing these reports, a professional bookkeeping service can help ensure your financial data is accurate, up-to-date, and easy to understand. Contact us today to learn how we can support your business with expert financial reporting and management!