Understanding Financial Reports: What Every Business Owner Needs to Know

Understanding Financial Reports: What Every Business Owner Needs to Know

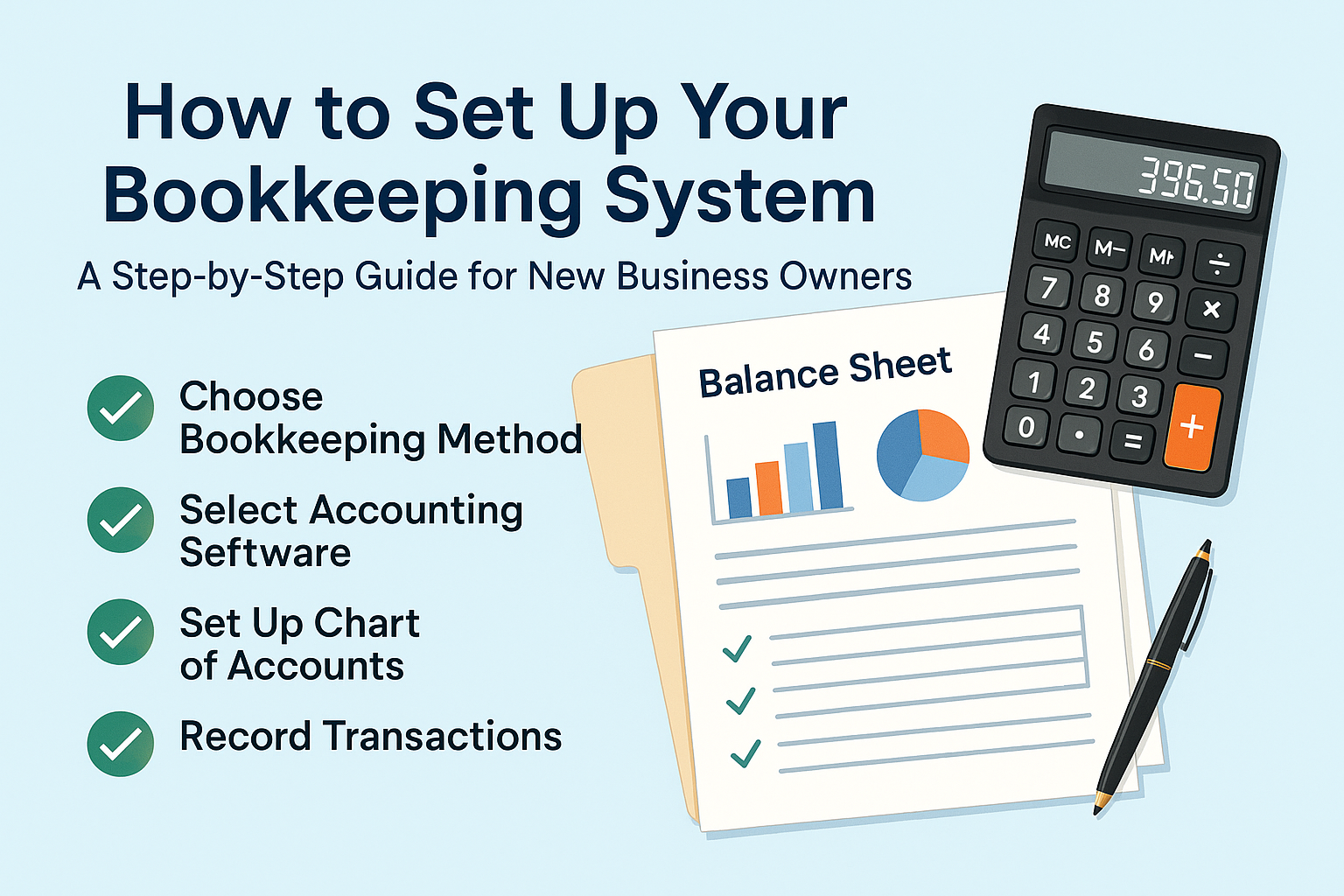

As a business owner, understanding and utilizing your financial reports is critical for making informed decisions and forecasting the future of your business. Financial reports provide a snapshot of your company’s financial health and are vital for business planning, budgeting, and securing funding. In this article, we will break down three of the most essential financial reports—Balance Sheet, Profit and Loss (P&L) Statement, and Cash Flow Statement—and explain how they connect to one another to help you make the right business decisions.

1. The Balance Sheet: A Snapshot of Your Financial Position

The Balance Sheet is a financial statement that provides a snapshot of your business’s financial position at a specific point in time. It shows what your business owns (assets), what it owes (liabilities), and the owner’s equity (the residual interest in the assets after deducting liabilities).

- Assets: Resources owned by the company that have value. These are usually divided into current assets (e.g., cash, inventory) and non-current assets (e.g., property, equipment).

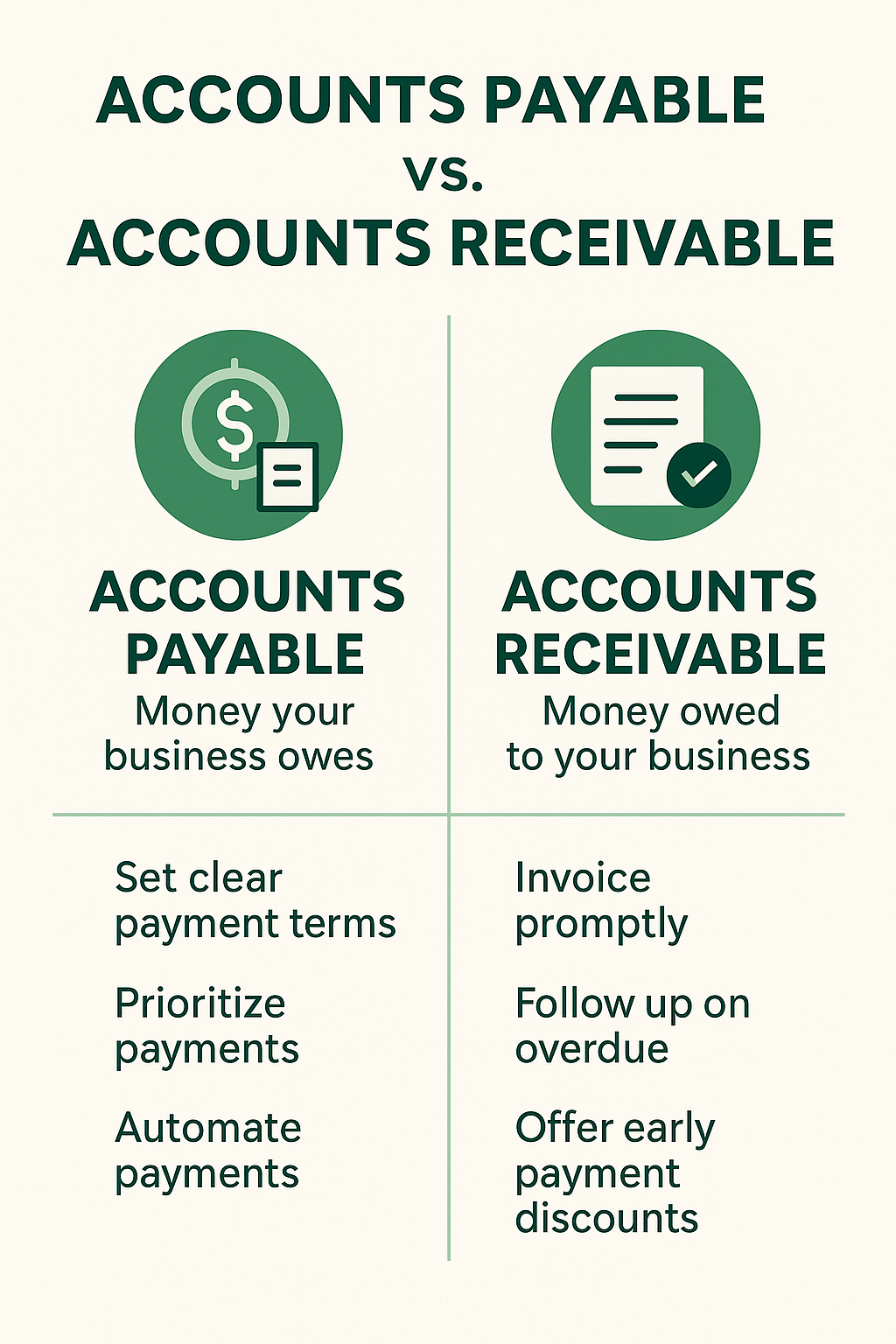

- Liabilities: Obligations your business owes to others. These include loans, accounts payable, and other debts.

- Equity: The owner’s share in the business. This is the difference between assets and liabilities, representing what is left over for the owners after debts are settled.

How it connects: The balance sheet helps determine the financial strength of the business by showing the relationship between assets, liabilities, and equity. This is a vital tool when securing loans or attracting investors because it shows the overall financial stability of the business.

2. Profit and Loss (P&L) Statement: Understanding Profitability

The Profit and Loss (P&L) Statement, also known as the income statement, shows the company’s profitability over a specific period, usually quarterly or annually. It outlines:

- Revenue: The total income from sales or services provided.

- Expenses: The costs incurred to generate revenue, including costs of goods sold (COGS), operational costs, salaries, rent, utilities, and other expenses.

- Net Profit or Loss: The result after subtracting expenses from revenue. A positive number is a profit, while a negative number is a loss.

How it connects: The P&L statement helps assess the business's performance over a given period. It shows whether the company is making a profit or running at a loss and highlights where the business is spending money.

By comparing the P&L statement with the balance sheet, you can understand how well your assets and liabilities are contributing to your profitability. If there are significant losses, it may indicate issues in expense management or pricing strategies, which will be key for business decisions.

3. Cash Flow Statement: Tracking Liquidity

The Cash Flow Statement tracks the flow of cash in and out of the business, providing a detailed picture of your business's liquidity. This statement is divided into three main sections:

- Operating Activities: Cash flow from the core business operations, including receipts from customers and payments to suppliers.

- Investing Activities: Cash flow from buying and selling assets like property, equipment, and investments.

- Financing Activities: Cash flow from external sources such as loans, shareholder investments, or dividend payments.

How it connects: While the P&L statement shows whether your business is profitable, the cash flow statement shows whether you have the liquidity to meet your obligations. Even if your business is profitable on paper, poor cash flow can result in an inability to pay bills, employee salaries, or reinvest in the business. By comparing the cash flow statement with the P&L and balance sheet, you can ensure that profits translate into actual cash, which is essential for smooth operations.

How These Financial Reports Connect to Each Other

Each of these financial reports provides different insights into the financial health of your business, but they are all interconnected:

- The Balance Sheet and P&L Statement: The balance sheet shows what you own and owe, while the P&L statement tracks your income and expenses. If your business is profitable, you should see a corresponding increase in equity on the balance sheet.

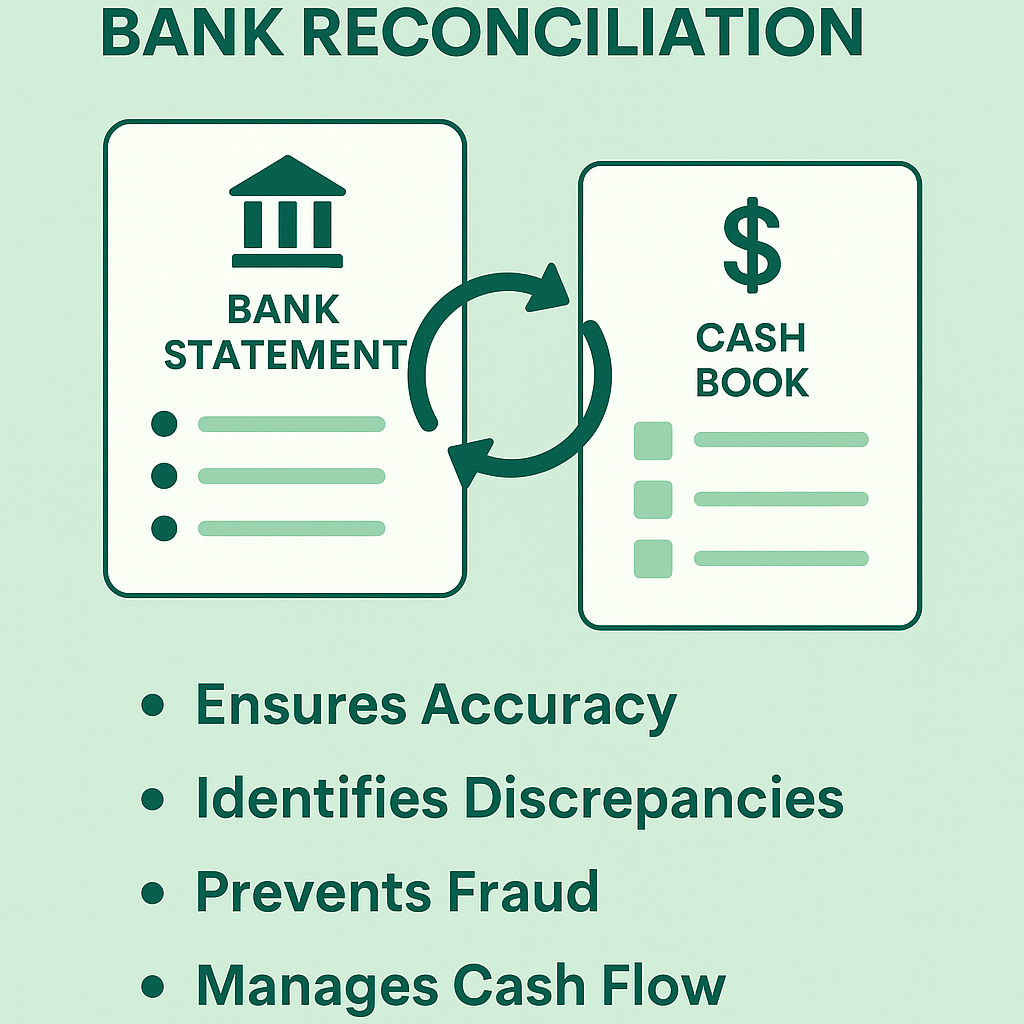

- The P&L Statement and Cash Flow Statement: Even if you are generating a profit on your P&L statement, your cash flow might be negative if your revenue is tied up in unpaid invoices. Conversely, you might have positive cash flow if you are delaying payments. The cash flow statement gives you a clearer picture of liquidity, helping you manage the timing of cash inflows and outflows.

- The Cash Flow Statement and Balance Sheet: The balance sheet shows your business’s long-term assets and liabilities, and the cash flow statement tells you how well you can fund those obligations through your operating activities. If you have substantial liabilities on the balance sheet, the cash flow statement can show whether you can meet those obligations as they come due.

Using These Reports for Business Decision-Making

Together, these three reports allow you to forecast your business’s financial future. By regularly reviewing them, you can:

- Spot trends in revenue and expenses: Understanding your profit margins and identifying areas where you can reduce costs or increase revenue will help you optimize your business operations.

- Forecast cash flow needs: Ensuring your business has enough liquidity to cover expenses and invest in growth initiatives is critical. The cash flow statement allows you to predict potential shortfalls in cash and make adjustments ahead of time.

- Make informed financial decisions: Whether you’re deciding whether to take on debt, hire more employees, or expand into new markets, these reports give you the data you need to make decisions based on financial realities.

Conclusion

Understanding and regularly reviewing your Balance Sheet, Profit and Loss (P&L) Statement, and Cash Flow Statement is crucial for the success of your business. These reports work together to give you a complete picture of your financial situation and help you make informed decisions that will drive your business toward long-term success.

At Sihamkami Bookkeeping Services, we specialize in helping businesses interpret these financial reports to make better decisions and set the right course for growth. Contact us today to learn how we can help you take control of your financial future.