How to Set Up Your Bookkeeping System: A Step-by-Step Guide for New Business Owners

How to Set Up Your Bookkeeping System: A Step-by-Step Guide for New Business Owners

As a new business owner, one of the most important tasks you’ll face is setting up an effective bookkeeping system. A solid bookkeeping system will help you manage your finances, ensure compliance with tax laws, and provide clarity on your business’s financial health. With the right setup, you can avoid costly mistakes and ensure that your business runs smoothly.

Here’s a step-by-step guide to help you set up a robust bookkeeping system from scratch.

Step 1: Choose the Right Bookkeeping Method

The first decision you’ll need to make is choosing between two common bookkeeping methods:

- Cash Basis: Under this method, you record income and expenses when money changes hands. It’s a simpler method and usually recommended for small businesses.

- Accrual Basis: In this method, you record income and expenses when they are earned or incurred, regardless of when money is actually exchanged. This method is more complex but provides a more accurate financial picture for larger businesses or those with inventory.

For most small businesses, the cash basis method is sufficient, but you should consider your business model and consult with a professional to choose the best approach.

Step 2: Select Bookkeeping Software

While you can manage your books manually using spreadsheets, it’s highly recommended to use bookkeeping software to automate and streamline your processes. Popular options include:

- QuickBooks Online: Ideal for small businesses, QuickBooks offers an easy-to-use platform that handles everything from invoicing to financial reporting.

- Xero: Xero is another cloud-based accounting software that’s great for small business owners who need a simple, easy-to-use platform with powerful tools.

- Wave: A free accounting software with essential features for small businesses just starting out.

Select the software that best fits your business needs, and ensure it integrates with your bank accounts and payment systems.

Step 3: Set Up Your Chart of Accounts

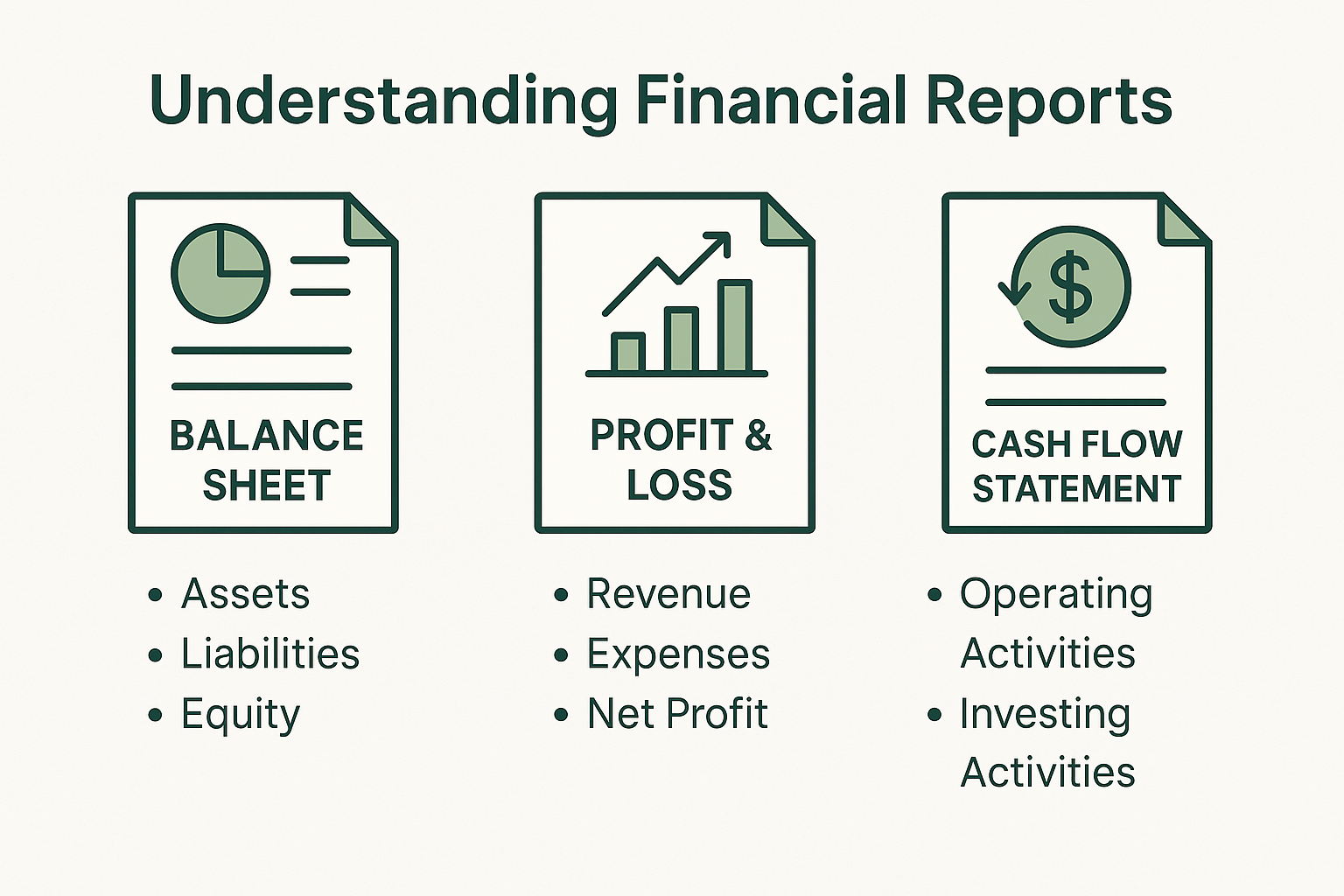

Your chart of accounts is the foundation of your bookkeeping system. It’s a list of categories that help you organize your financial transactions. Common categories in a small business chart of accounts include:

- Assets: Everything your business owns (e.g., cash, inventory, equipment).

- Liabilities: Debts your business owes (e.g., loans, credit cards).

- Equity: The owner’s share of the business.

- Revenue: Income your business earns.

- Expenses: Costs associated with running your business.

Work with your accountant or bookkeeper to set up your chart of accounts, making sure it aligns with your business activities.

Step 4: Record Your Transactions

Once your system is set up, you’ll need to regularly record your business transactions. This includes income, expenses, and any other financial activity related to your business.

You can record transactions manually, but using your bookkeeping software will simplify this process. Make sure you:

- Record every transaction, no matter how small.

- Keep receipts and invoices for every expense to ensure accurate record-keeping.

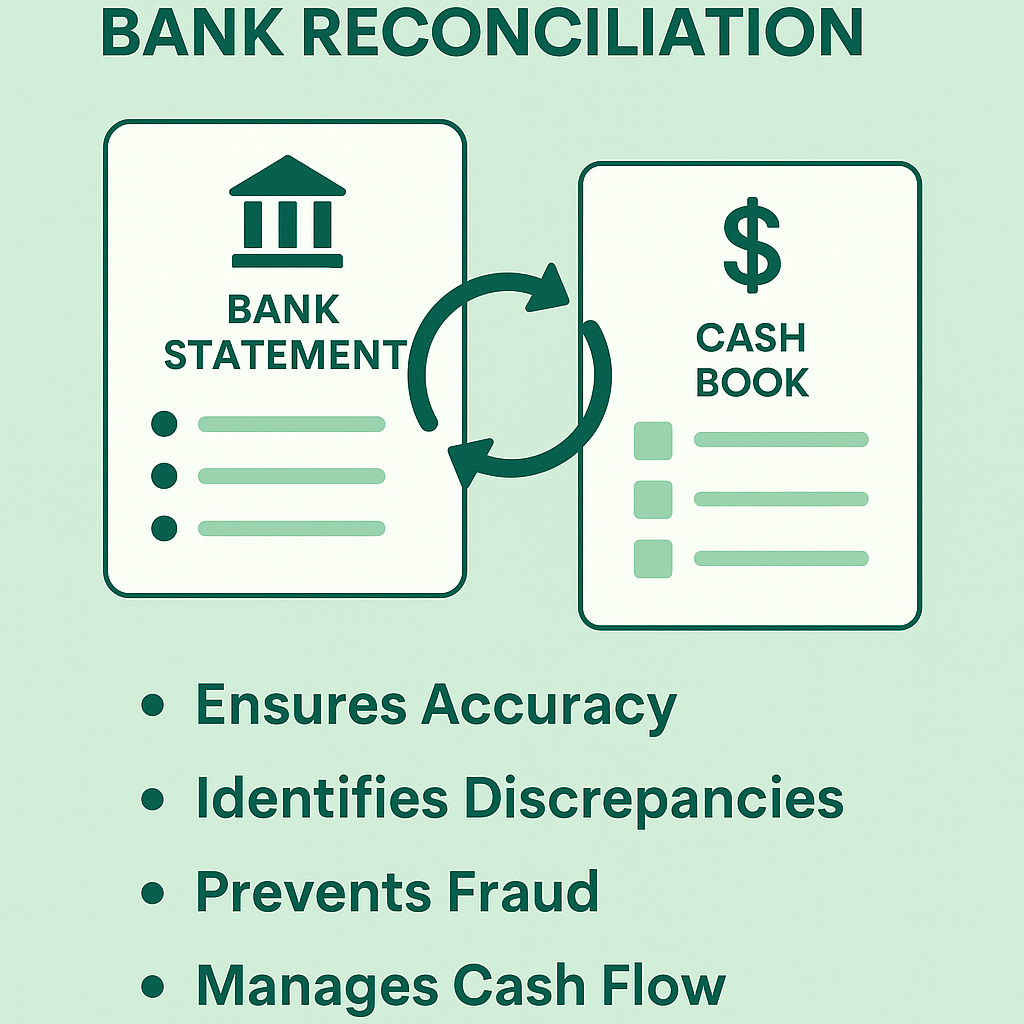

- Reconcile your bank statements monthly to ensure your records match your actual cash flow.

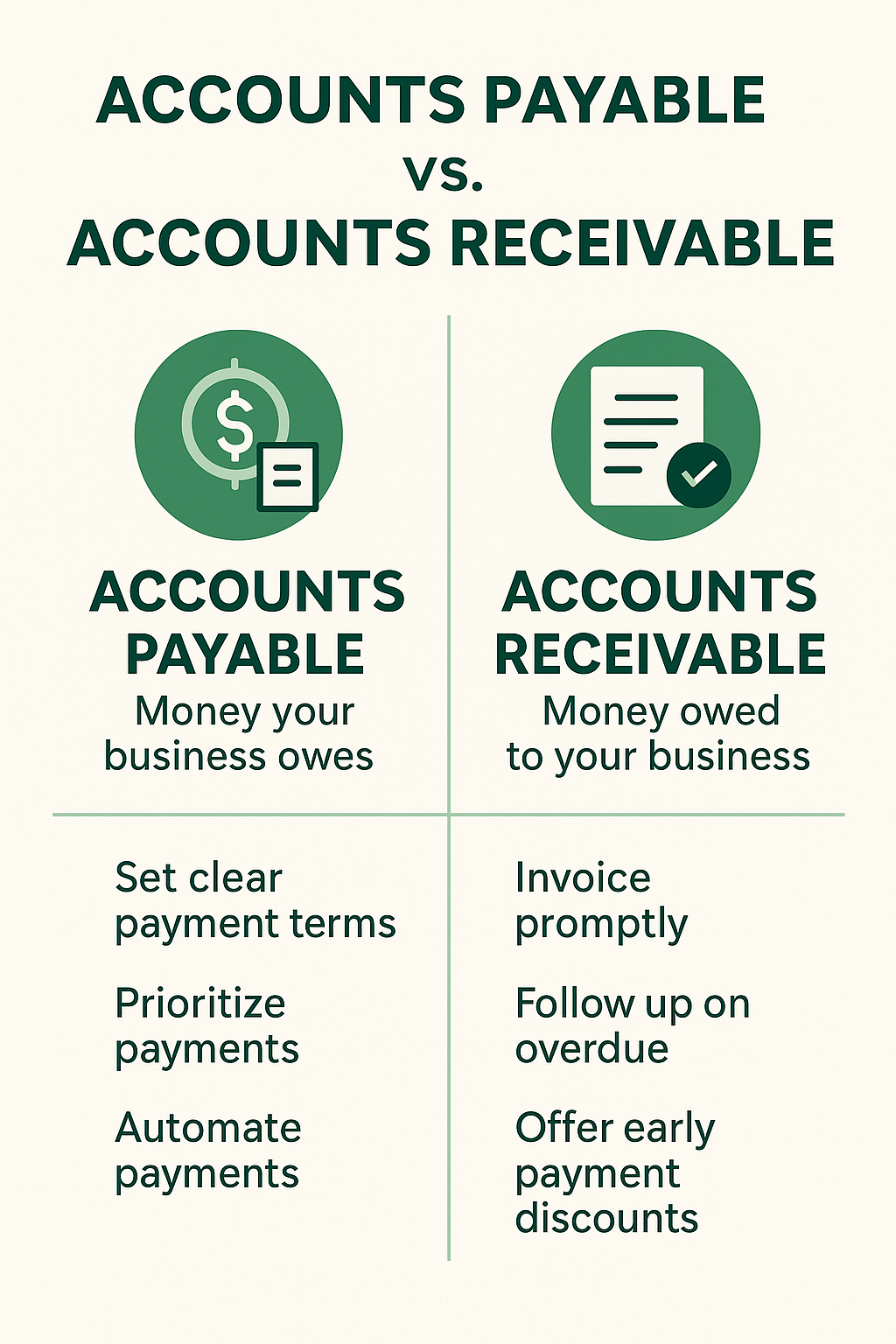

Step 5: Set Up a System for Invoicing and Payments

Having a system for invoicing and tracking payments is crucial for maintaining healthy cash flow. Here’s how you can set it up:

- Create professional invoices: Your bookkeeping software will likely have templates for creating invoices that you can customize with your business name, logo, and payment terms.

- Track outstanding invoices: Keep track of which customers have paid and which are overdue. This will help you stay on top of your receivables.

- Payment methods: Offer various payment methods to make it easier for customers to pay. Consider using payment processors like PayPal, Stripe, or your bank’s merchant services.

Step 6: Set a Schedule for Regular Bookkeeping Tasks

The key to maintaining an efficient bookkeeping system is staying consistent. Set up a schedule for regular tasks such as:

- Daily: Record transactions, review receipts, and track sales.

- Weekly: Review cash flow, process invoices, and update financial records.

- Monthly: Reconcile bank accounts, review your profit and loss statements, and generate financial reports.

Staying organized and consistent will make tax season easier and help you make better financial decisions throughout the year.

Step 7: Monitor and Adjust Your System as You Grow

As your business grows, your bookkeeping needs will evolve. Review your system regularly and make adjustments as necessary. This may involve upgrading your software, adjusting your chart of accounts, or hiring a professional to assist with more complex bookkeeping tasks.

Conclusion

Setting up a solid bookkeeping system is a crucial step in building a successful business. By following these steps and maintaining consistent records, you’ll have a clear understanding of your financial situation and be better equipped to make informed decisions. Whether you’re handling the books yourself or working with a bookkeeper, the right system will help you grow your business and ensure long-term financial stability.

At Sihamkami Bookkeeping Services, we specialize in helping new business owners set up their bookkeeping systems. Let us help you streamline your financial processes so you can focus on what you do best—growing your business.