Why Small Businesses Should Move to Cloud-Based Bookkeeping Solutions

Why Small Businesses Should Move to Cloud-Based Bookkeeping Solutions

In today’s fast-paced digital world, small businesses need tools that are efficient, cost-effective, and scalable. One of the best ways to streamline your business’s financial management is by switching to cloud-based bookkeeping solutions. Unlike traditional bookkeeping methods, cloud-based systems offer flexibility, real-time access, and enhanced security—all of which are crucial for business growth. In this article, we’ll explore why small businesses should make the move to cloud-based bookkeeping and the benefits it brings.

1. Access Your Financial Data Anytime, Anywhere

One of the biggest advantages of cloud-based bookkeeping is the ability to access your financial information from any device, anywhere in the world. Whether you’re in the office, at home, or traveling, cloud-based systems allow you to log in and view your financial data in real time. This flexibility is essential for small business owners who are often on the go, enabling them to make informed decisions quickly without waiting to get back to their desktop computers.

2. Improved Collaboration

Cloud-based bookkeeping systems make it easy to collaborate with your accountant, bookkeeper, or financial team. Multiple users can access the same financial data simultaneously, ensuring everyone stays updated and on the same page. This eliminates the need for sending back-and-forth emails with large attachments or outdated spreadsheets. With cloud-based systems, you can streamline communication and work more efficiently with your financial professionals.

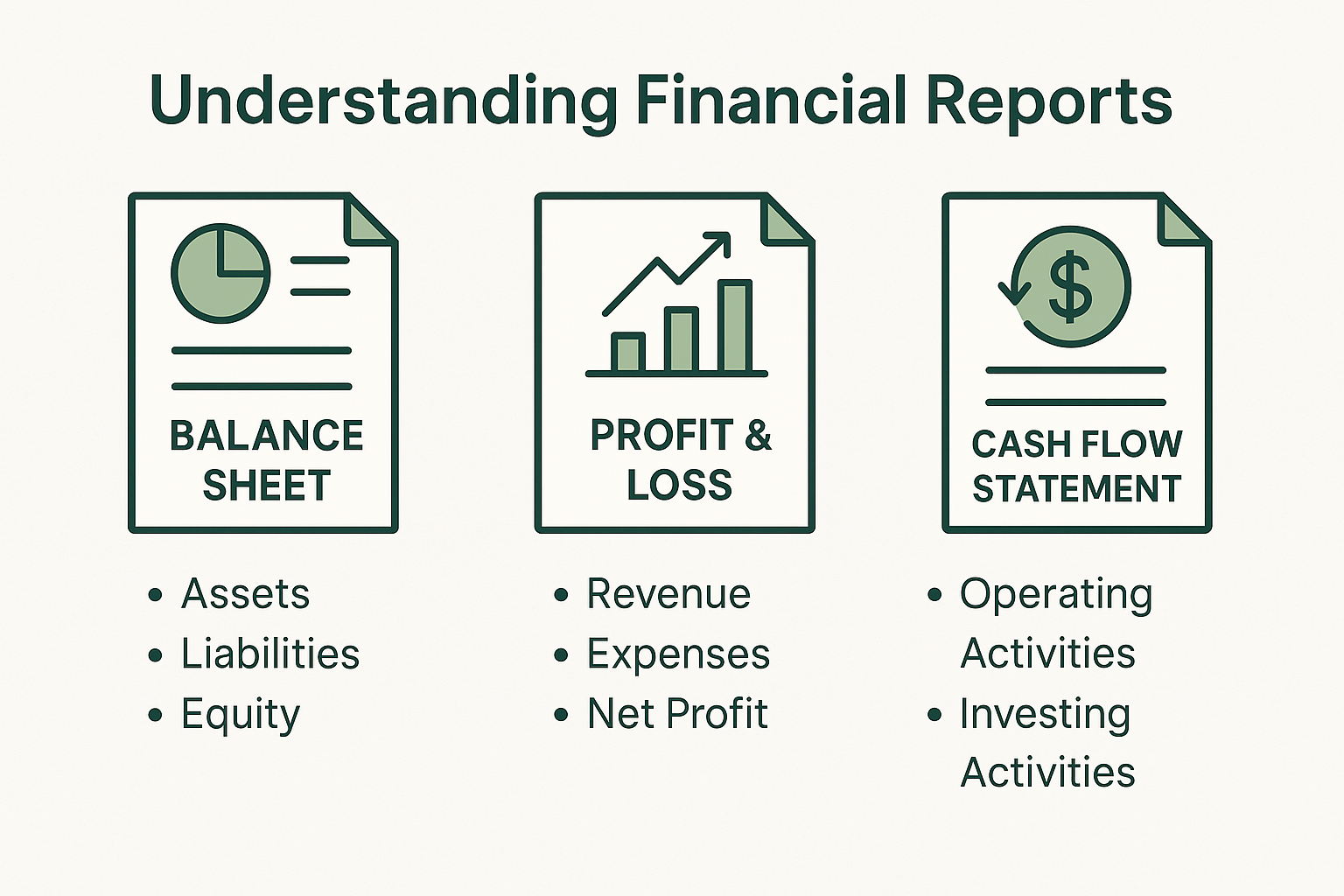

3. Real-Time Financial Insights

Keeping your financial records up to date is essential for making informed decisions about your business. Cloud-based bookkeeping solutions automatically update your records in real time as transactions occur. This means you can generate accurate financial reports at any moment, giving you a clearer picture of your business’s financial health. Whether you need to check your cash flow, profit and loss, or balance sheet, the information is always current and available at your fingertips.

4. Enhanced Data Security

Security is a top concern for any business, especially when it comes to financial data. Cloud-based bookkeeping solutions offer robust security measures to protect your information. These systems typically use advanced encryption methods, regular data backups, and multi-factor authentication to ensure your financial data is safe from cyber threats and unauthorized access. By using a cloud-based solution, you can rest assured that your data is stored securely and is less susceptible to risks like theft or hardware failure.

5. Cost-Effective and Scalable

Traditional bookkeeping software often requires expensive upfront costs for installation, updates, and maintenance. In contrast, cloud-based bookkeeping solutions are subscription-based, offering affordable monthly or annual plans that are more cost-effective for small businesses. Additionally, these systems are scalable, meaning they can grow with your business. As your business expands and your bookkeeping needs increase, you can easily upgrade your plan without the hassle of reinstalling software or purchasing new licenses.

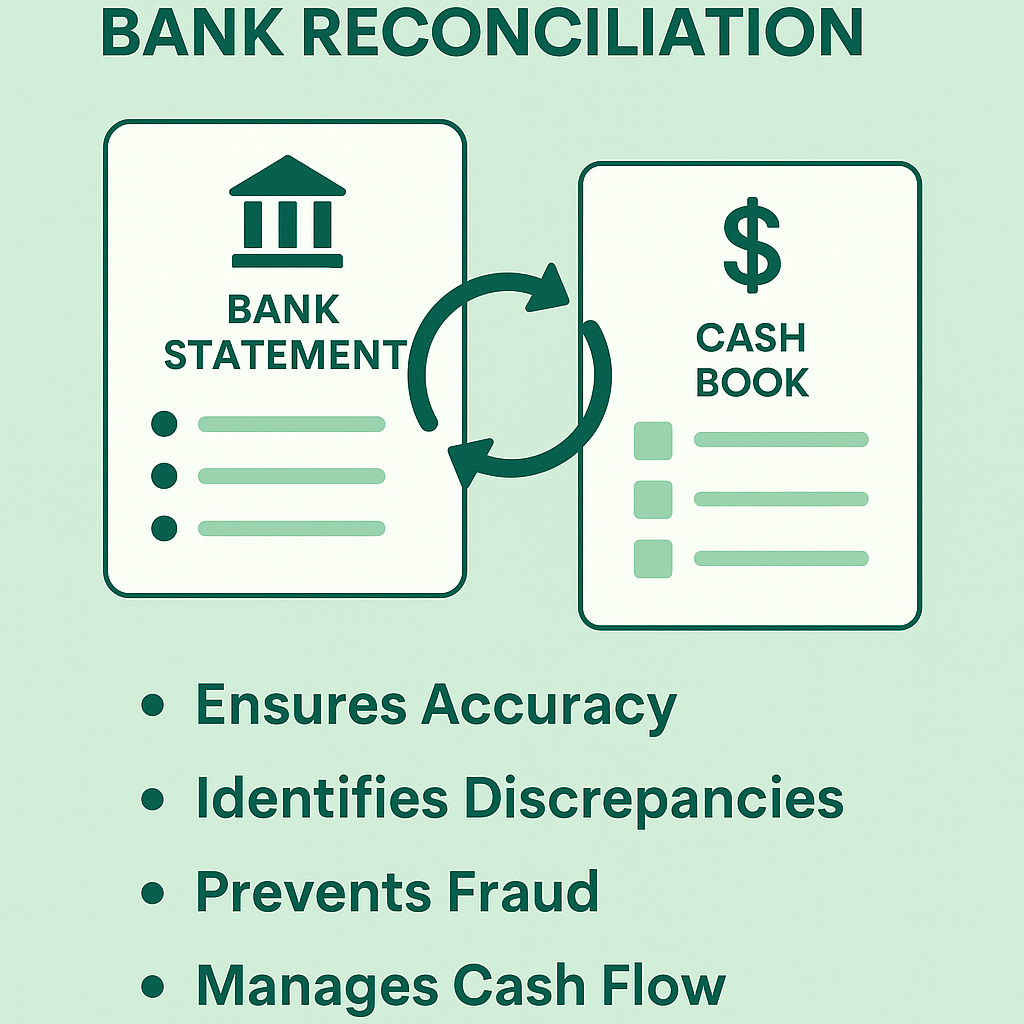

6. Automated Bookkeeping Tasks

Cloud-based solutions automate many of the repetitive tasks involved in bookkeeping, such as bank reconciliations, invoicing, and expense tracking. This automation not only saves time but also reduces the risk of human error. For small businesses with limited time and resources, automation can be a game-changer, allowing you to focus on more strategic tasks like growing your business.

7. Environmentally Friendly

By moving to a cloud-based bookkeeping system, you reduce the need for paper records, printed invoices, and physical storage space. This not only cuts down on clutter but also contributes to an environmentally friendly office. Small businesses that adopt cloud solutions are making strides toward becoming more sustainable by minimizing their reliance on paper and other resources.

8. Stay Compliant with Ease

Tax laws and financial regulations are constantly changing, and it can be challenging for small businesses to stay compliant. Cloud-based bookkeeping software is regularly updated to reflect the latest changes in tax laws and regulations, ensuring that your business remains compliant with minimal effort. This reduces the risk of errors or penalties when it’s time to file taxes.

Conclusion

Cloud-based bookkeeping solutions offer a wide range of benefits for small businesses, from increased flexibility and real-time financial insights to enhanced security and automation. By moving to a cloud-based system, you can streamline your bookkeeping processes, save time and money, and focus on what truly matters—growing your business. Whether you’re just starting out or looking to upgrade your current financial management system, cloud-based bookkeeping is a smart investment for the future of your business.

If you’re ready to make the switch to cloud-based bookkeeping, our expert services can help guide you through the transition. Contact us today to learn more about how we can support your business’s financial needs!