How Bookkeeping Services Can Save You Time and Money

How to Choose the Right Bookkeeping Service for Your Business

As a business owner, your time is one of your most valuable assets. Between managing operations, growing your customer base, and overseeing staff, there’s often little time left to handle the complexities of bookkeeping. Yet, maintaining accurate financial records is crucial for the success of your business. This is where professional bookkeeping services come into play. By outsourcing your bookkeeping, you can save both time and money, allowing you to focus on what matters most—growing your business. In this article, we’ll explore how bookkeeping services can be a game-changer for your business.

1. Freeing Up Your Time

One of the most immediate benefits of outsourcing bookkeeping is the time you save. Bookkeeping is a time-consuming task that requires attention to detail and regular maintenance. When you handle bookkeeping in-house, it can quickly consume hours of your time each week, time that could be better spent on strategic activities that drive growth. By hiring a professional bookkeeping service, you delegate these tasks to experts who can manage your financial records efficiently and accurately. This frees up your time to focus on running your business, developing new products or services, and engaging with customers.

2. Reducing Errors and Avoiding Costly Mistakes

Bookkeeping mistakes can be costly. Errors in financial records can lead to overpayment of taxes, missed deductions, and even penalties from tax authorities. Additionally, inaccurate financial data can result in poor decision-making, which can have long-term negative impacts on your business. Professional bookkeepers are trained to manage financial records with precision, ensuring that your books are accurate and up-to-date. By reducing errors, you not only save money but also avoid the stress and potential financial losses associated with bookkeeping mistakes.

3. Cost-Effective Expertise

Hiring a full-time, in-house bookkeeper can be expensive, especially for small businesses. Beyond salary, there are additional costs such as benefits, training, and office space. On the other hand, outsourcing your bookkeeping to a professional service is often more cost-effective. You pay only for the services you need, when you need them, without the overhead costs of an in-house employee. Additionally, bookkeeping services bring specialized expertise that might be difficult to find in a single in-house bookkeeper. This means you get high-quality financial management at a fraction of the cost.

4. Better Cash Flow Management

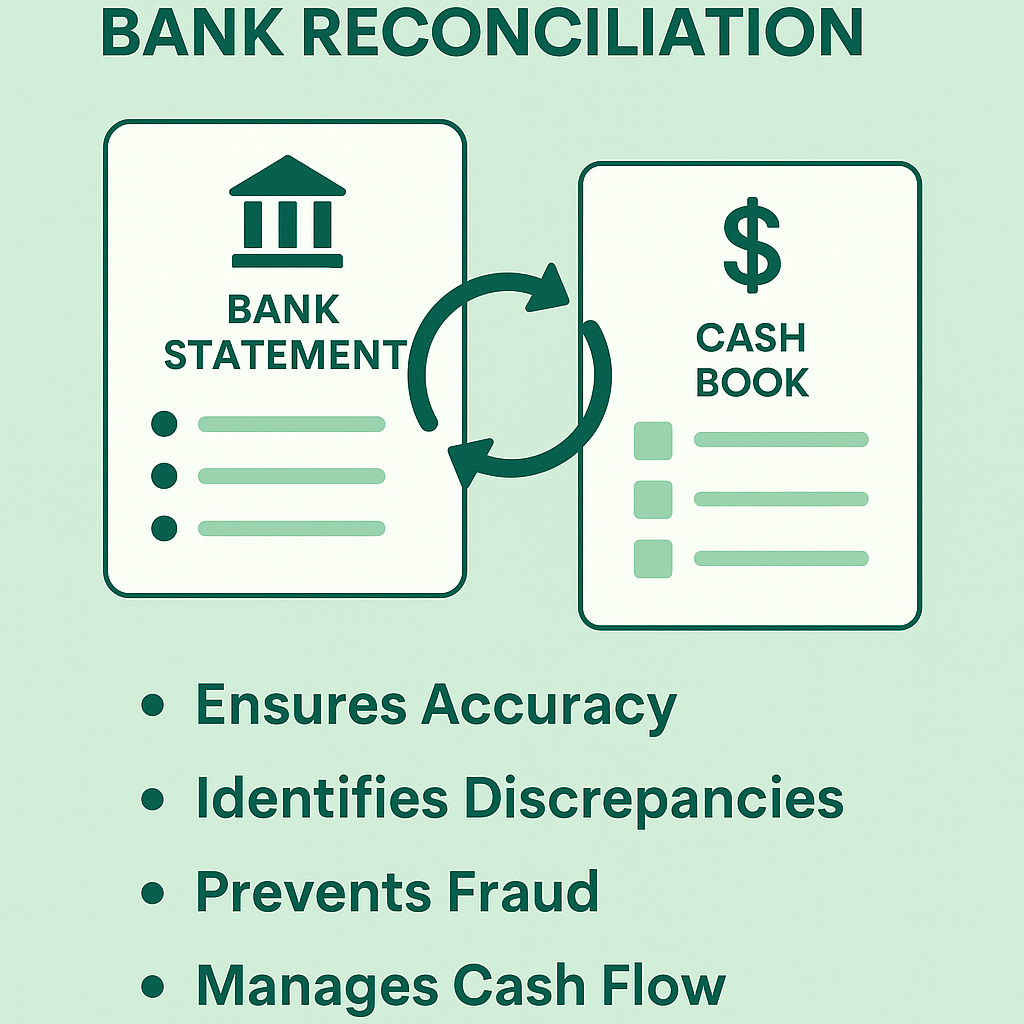

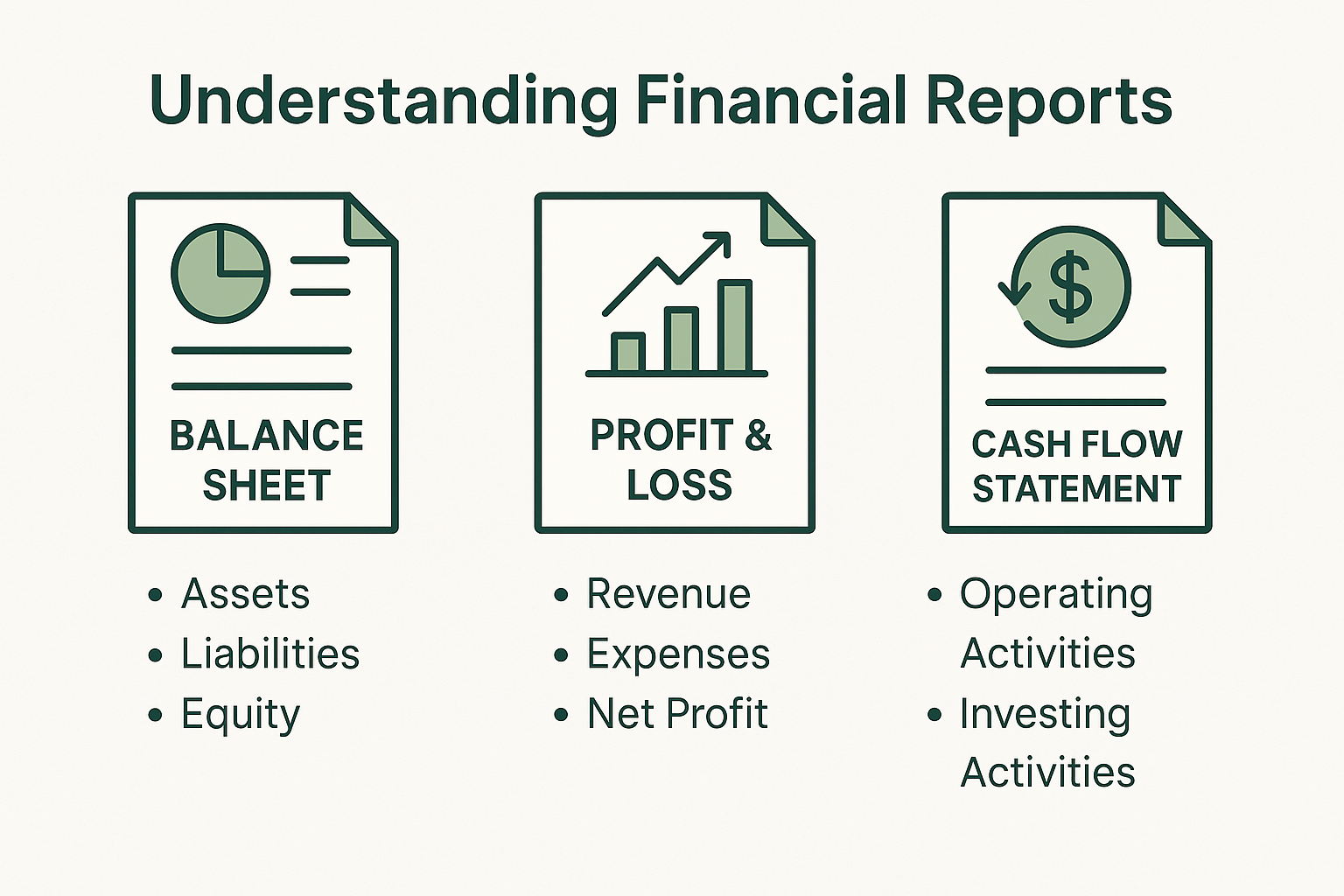

Effective cash flow management is essential for business success. Poor cash flow management can lead to financial difficulties, even if your business is profitable on paper. Professional bookkeepers help you maintain accurate records of income and expenses, enabling you to monitor your cash flow closely. They can also provide regular financial reports that give you a clear view of your cash position, helping you make informed decisions about spending, investments, and savings. By keeping your cash flow in check, you avoid unnecessary overdrafts, late fees, and other financial pitfalls.

5. Streamlined Tax Preparation

Tax season can be a stressful time for business owners, especially if your financial records are not in order. Bookkeeping services can make tax preparation much easier and more efficient. Professional bookkeepers ensure that all your financial records are accurate and up-to-date, making it simple to gather the necessary documents and file your taxes on time. They can also help you identify deductions and credits you may have missed, potentially saving you money on your tax bill. By streamlining the tax preparation process, bookkeeping services help you avoid the last-minute rush and reduce the risk of errors or audits.

6. Access to Advanced Tools and Technology

Bookkeeping services often use the latest accounting software and tools to manage financial records. These tools not only improve accuracy but also provide valuable insights into your business’s financial performance. For example, cloud-based accounting software allows you to access your financial data in real-time from anywhere, providing greater flexibility and control. Additionally, many bookkeeping services offer automated processes for tasks like invoicing, expense tracking, and payroll, further saving you time and reducing manual errors. By leveraging advanced technology, bookkeeping services help you stay ahead of the curve and manage your finances more effectively.

7. Enhanced Financial Planning and Decision-Making

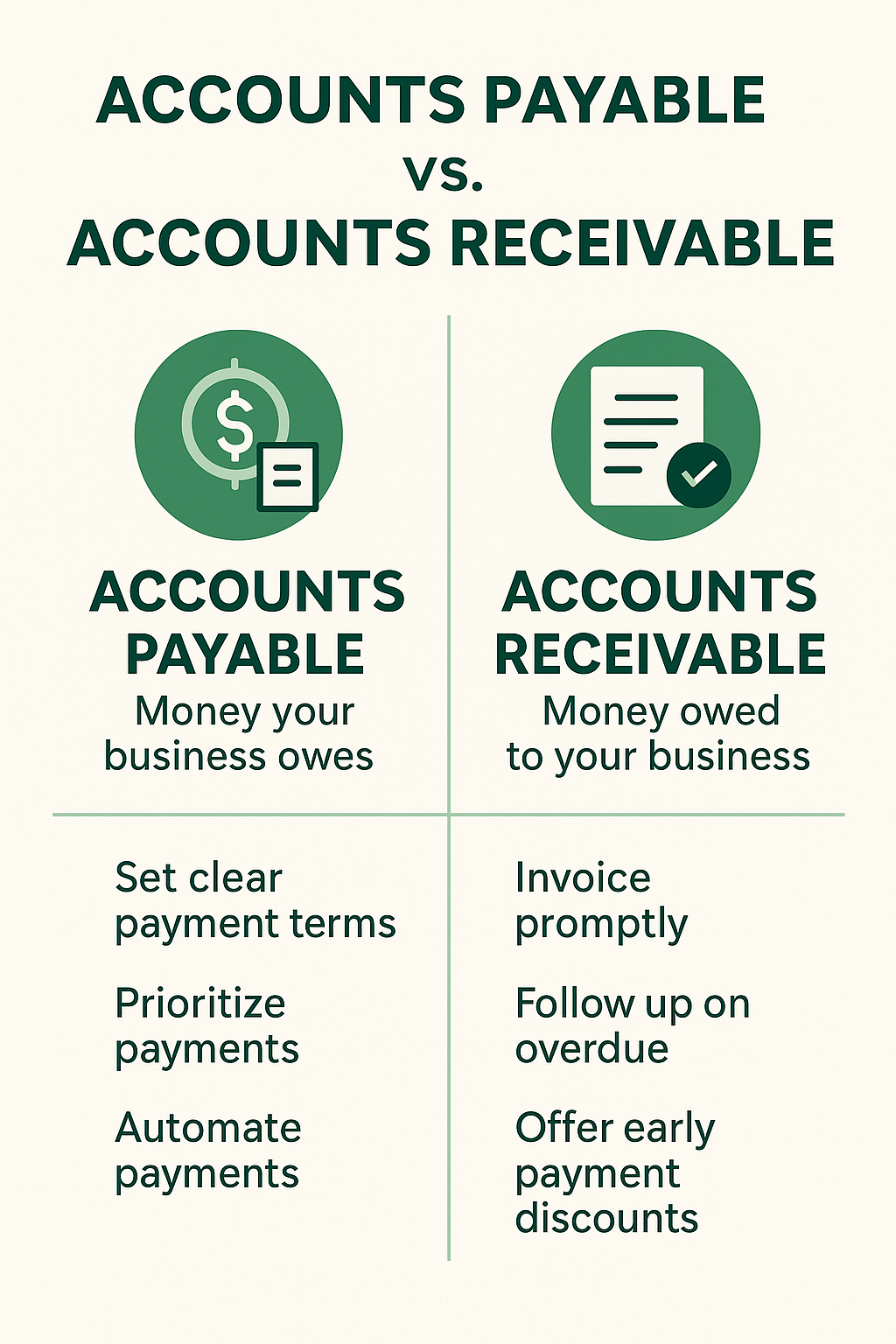

Accurate and timely financial records are the foundation of sound financial planning. With the help of a professional bookkeeping service, you can gain a deeper understanding of your business’s financial health and make more informed decisions. Regular financial reports, such as profit and loss statements, balance sheets, and cash flow statements, provide insights into your business’s strengths and weaknesses. This information is crucial for setting financial goals, creating budgets, and planning for growth. By having a clear picture of your financial situation, you can make strategic decisions that drive long-term success.

Conclusion

Bookkeeping is a critical aspect of running a successful business, but it doesn’t have to be a burden. By outsourcing your bookkeeping to a professional service, you can save valuable time, reduce costs, and ensure that your financial records are accurate and up-to-date. Whether you’re a small business owner looking to streamline operations or a growing company seeking to enhance financial management, bookkeeping services offer a cost-effective solution that supports your business’s success.

If you’re ready to take the next step in optimizing your business’s financial management, our bookkeeping services are here to help. Contact us today to learn more about how we can save you time and money, and help you focus on what matters most—growing your business