How to Choose the Right Bookkeeping Service for Your Business

How to Choose the Right Bookkeeping Service for Your Business

Selecting the right bookkeeping service is a critical decision for any business. Accurate and efficient bookkeeping is the foundation of good financial management, enabling you to make informed decisions, maintain compliance, and drive growth. However, with so many options available, choosing the right bookkeeping service can be overwhelming. In this article, we’ll explore the key factors to consider when selecting a bookkeeping service that best suits your business needs.

1. Understand Your Business Needs

Before you start looking for a bookkeeping service, it’s important to assess your business’s specific needs. Consider the following questions:

- What is the size of your business?

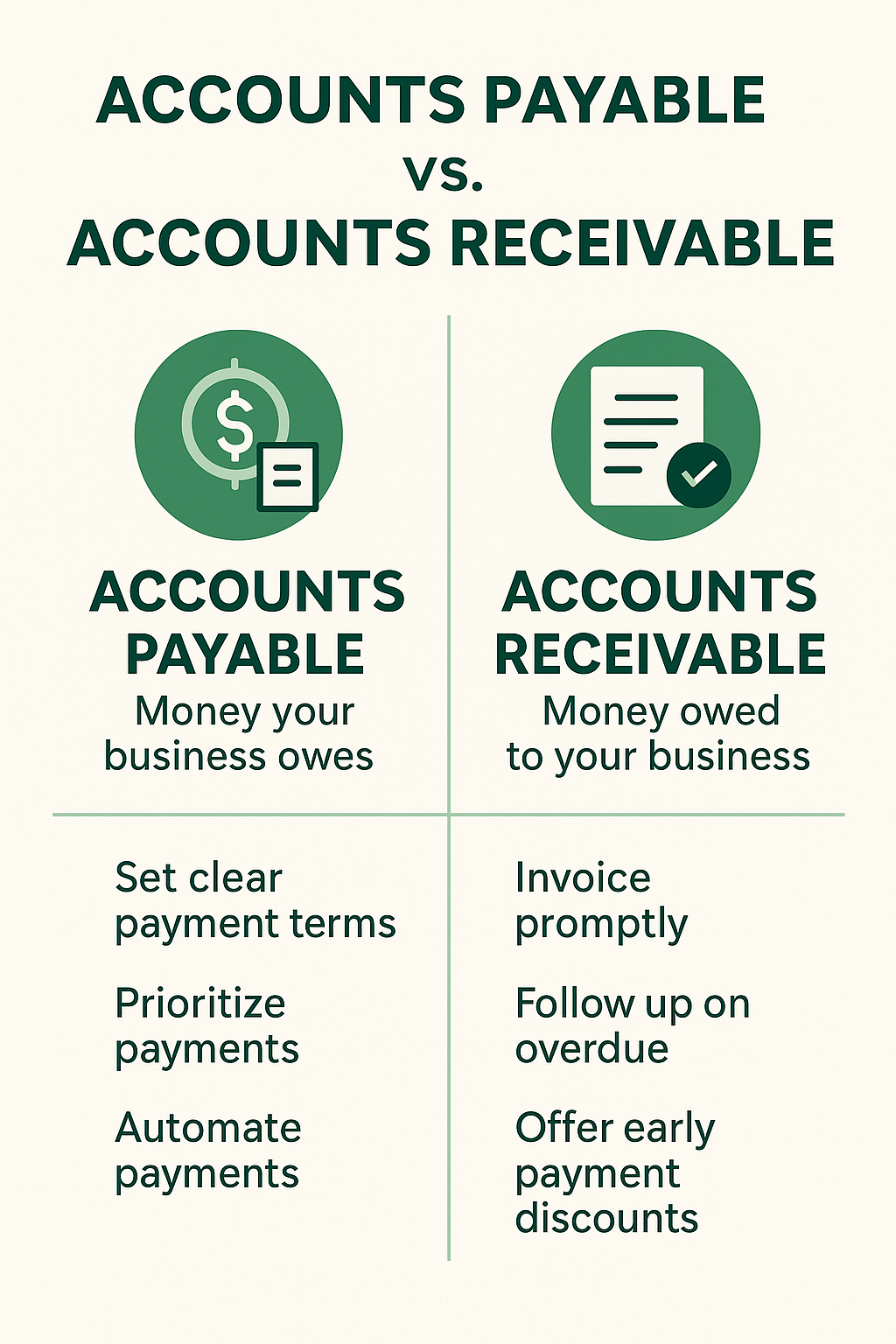

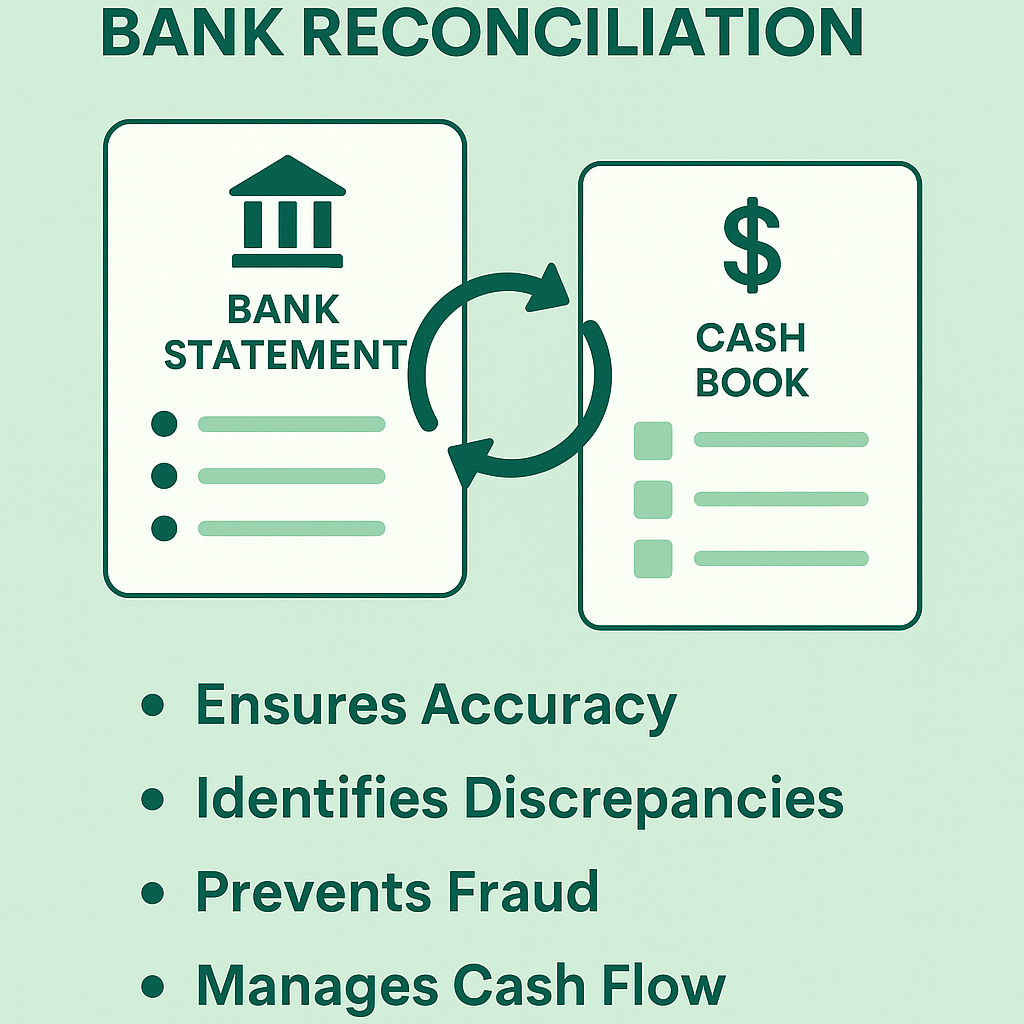

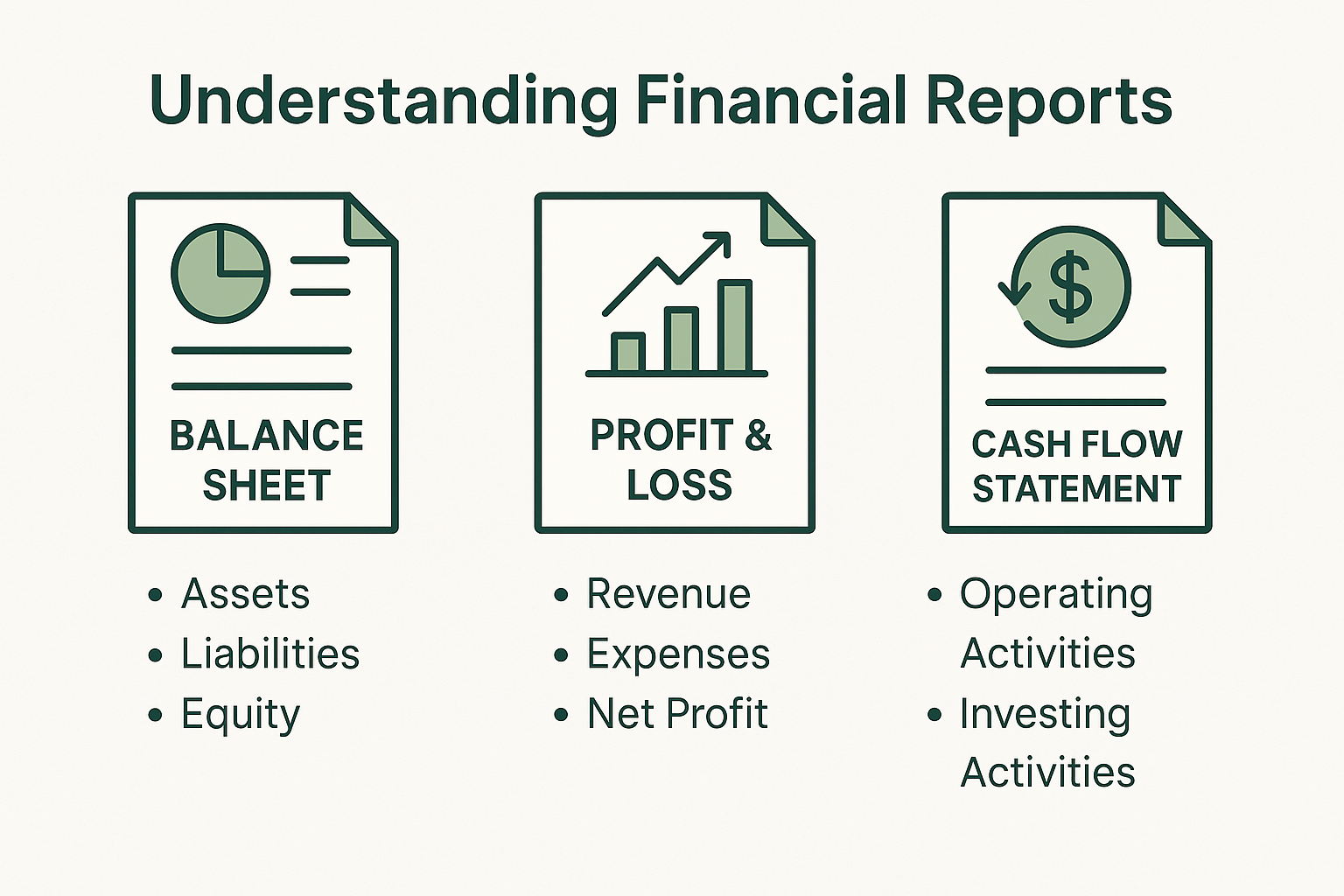

- Do you need basic bookkeeping services like invoicing and expense tracking, or more advanced services like payroll processing and financial reporting?

- How complex are your financial transactions?

- Do you need industry-specific expertise, such as knowledge of construction, retail, or non-profit bookkeeping?

Understanding your requirements will help you narrow down your options and find a service that aligns with your business needs.

2. Consider the Service’s Experience and Expertise

Experience matters when it comes to bookkeeping. Look for a service provider with a proven track record in your industry. An experienced bookkeeper will be familiar with the unique challenges your business faces and can provide tailored advice and support. Additionally, check if the bookkeeping service has certifications or affiliations with professional organizations, such as the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB).

3. Evaluate the Technology and Software Used

In today’s digital age, the technology and software used by a bookkeeping service are crucial. Ensure that the service provider uses up-to-date, cloud-based software that allows you to access your financial data in real-time from anywhere. Popular bookkeeping software options include QuickBooks, Xero, and FreshBooks. The right software can streamline your bookkeeping processes, improve accuracy, and make it easier to collaborate with your bookkeeper.

4. Check for Scalability

As your business grows, your bookkeeping needs will likely evolve. It’s important to choose a bookkeeping service that can scale with your business. Ask potential service providers if they can handle increased transaction volumes, more complex financial reporting, and additional services as your business expands. A scalable bookkeeping service will save you the hassle of switching providers as your business grows.

5. Assess Communication and Support

Effective communication is key to a successful bookkeeping relationship. Look for a service provider that is responsive and offers clear, consistent communication. Consider how they handle inquiries, provide updates, and report on your financial status. It’s also important to check if they offer ongoing support and are available to answer questions or provide assistance when needed.

6. Understand the Pricing Structure

Bookkeeping services can vary widely in terms of pricing. Some providers charge a flat monthly fee, while others may charge hourly rates or offer customizable packages based on your needs. Make sure you understand the pricing structure and what services are included. Be wary of hidden fees and ensure that the service you choose offers good value for your investment.

7. Request References and Reviews

Before making a decision, ask for references from the bookkeeping service’s current or past clients. Speaking with other business owners who have used their services can provide valuable insights into the service provider’s reliability, accuracy, and customer service. Additionally, check online reviews and ratings to get a broader perspective on the service provider’s reputation.

8. Consider Data Security

Financial data is sensitive, and it’s crucial to ensure that your bookkeeping service has robust data security measures in place. Ask about their data encryption practices, backup procedures, and how they protect your financial information from unauthorized access. A reputable bookkeeping service will prioritize data security to safeguard your business’s financial records.

9. Evaluate the Level of Personalization

Every business is unique, and your bookkeeping service should be able to tailor its services to meet your specific needs. Look for a provider that offers a personalized approach, taking the time to understand your business and customize their services accordingly. A one-size-fits-all approach may not be effective, especially if your business has specific requirements or complexities.

10. Trust Your Instincts

Finally, trust your instincts when choosing a bookkeeping service. After considering all the practical factors, it’s important to feel comfortable with the service provider you choose. A good working relationship is based on trust and mutual respect, so choose a bookkeeping service that you feel confident will support your business’s financial health.

Conclusion

Choosing the right bookkeeping service is a crucial step in managing your business’s finances effectively. By considering factors such as your business needs, the service provider’s experience, technology, scalability, communication, and data security, you can find a bookkeeping service that fits your business and supports its growth. Take the time to evaluate your options carefully, and you’ll set the foundation for a strong financial partnership that helps your business thrive.

If you’re looking for a reliable bookkeeping service tailored to your business needs, we’re here to help. Contact us today to learn more about how we can support your business’s financial management and help you achieve your goals.