How Regular Financial Reporting Can Benefit Your Business

How Regular Financial Reporting Can Benefit Your Business

In the fast-paced world of business, making informed decisions quickly is essential to staying competitive and achieving growth. One of the most powerful tools at your disposal is regular financial reporting. While many business owners focus on the day-to-day operations, regular financial reports provide critical insights that can drive strategic planning, improve financial management, and ultimately lead to greater business success. In this article, we’ll explore how regular financial reporting can benefit your business and why it’s a practice you can’t afford to overlook.

1. Informed Decision-Making

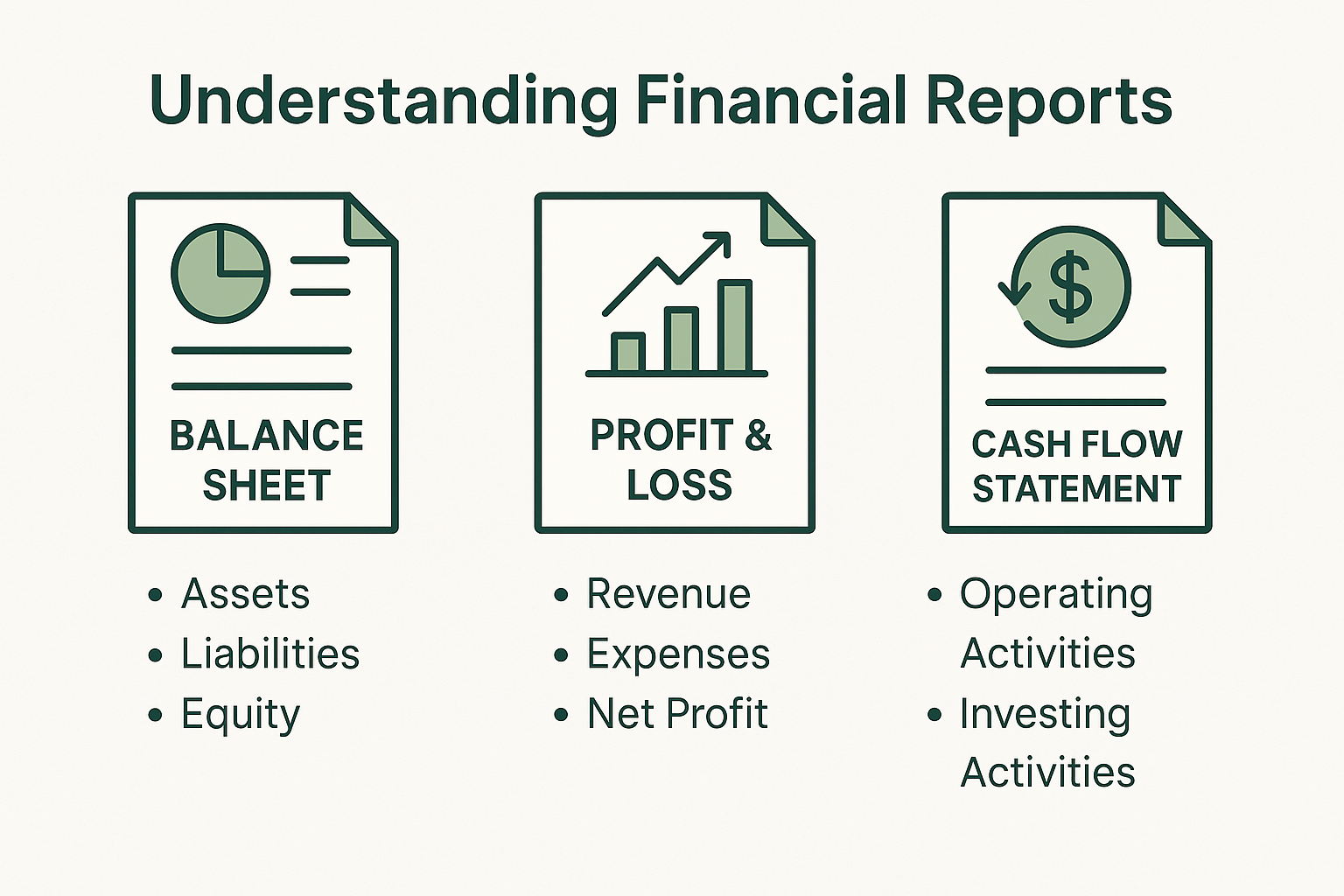

Regular financial reporting provides a clear and up-to-date picture of your business’s financial health. By reviewing financial reports such as income statements, balance sheets, and cash flow statements, you can make informed decisions based on real data. Whether you’re considering expanding your business, investing in new equipment, or adjusting your pricing strategy, financial reports give you the insights needed to make decisions with confidence.

2. Improved Cash Flow Management

Cash flow is the lifeblood of any business, and managing it effectively is crucial for long-term success. Regular financial reporting allows you to monitor your cash flow closely, ensuring that you have enough funds to cover your expenses and invest in growth opportunities. By regularly reviewing cash flow statements, you can identify potential cash shortages before they become a problem and take proactive steps to address them.

3. Enhanced Budgeting and Forecasting

A key component of financial management is budgeting and forecasting. Regular financial reports provide the data needed to create accurate budgets and financial forecasts. By analyzing past performance and current trends, you can set realistic financial goals and allocate resources more effectively. This level of planning helps you stay on track and adjust your strategies as needed to achieve your business objectives.

4. Early Identification of Financial Issues

One of the significant benefits of regular financial reporting is the ability to identify potential financial issues early. Whether it’s declining sales, increasing expenses, or a drop in profitability, financial reports can highlight these problems before they escalate. By catching issues early, you can take corrective action and avoid more serious financial challenges down the road.

5. Strengthened Stakeholder Relationships

If your business has investors, lenders, or other stakeholders, regular financial reporting is essential for maintaining their trust and confidence. Stakeholders want to know that your business is financially stable and well-managed. By providing regular financial reports, you demonstrate transparency and accountability, which can strengthen your relationships and make it easier to secure future funding or investment.

6. Better Tax Preparation and Compliance

Preparing for tax season can be a stressful process, but regular financial reporting can make it much easier. By maintaining up-to-date financial records, you can ensure that all necessary information is readily available when it’s time to file taxes. Regular reporting also helps you stay compliant with tax regulations, reducing the risk of errors, penalties, or audits.

7. Improved Financial Performance

Ultimately, the goal of regular financial reporting is to improve your business’s financial performance. By regularly reviewing your financial reports, you can track your progress toward your financial goals, measure the effectiveness of your strategies, and make data-driven decisions that drive growth. This ongoing process of review and adjustment helps ensure that your business remains on a path to success.

Conclusion

Regular financial reporting is a powerful tool that can provide numerous benefits for your business. From informed decision-making and improved cash flow management to enhanced budgeting and early identification of issues, financial reports offer valuable insights that can drive your business’s growth and success. By making financial reporting a regular practice, you can ensure that your business is always operating with the best possible information, helping you stay ahead of the competition and achieve your goals.

If you need assistance with setting up regular financial reporting for your business, our bookkeeping services are here to help. We can provide you with accurate and timely financial reports that give you the insights you need to make informed decisions and keep your business on track. Contact us today to learn more about how we can support your business’s financial management needs.