The Role of Bookkeeping in Securing Business Loans

The Role of Bookkeeping in Securing Business Loans

Securing a business loan can be a critical step in growing your company, whether you're looking to expand operations, purchase new equipment, or manage cash flow. However, obtaining a loan isn’t always straightforward—lenders need assurance that your business is financially stable and capable of repaying the loan. This is where accurate and organized bookkeeping plays a pivotal role. In this blog, we’ll explore how effective bookkeeping can enhance your chances of securing a business loan and why maintaining accurate financial records is essential.

1. Demonstrating Financial Health

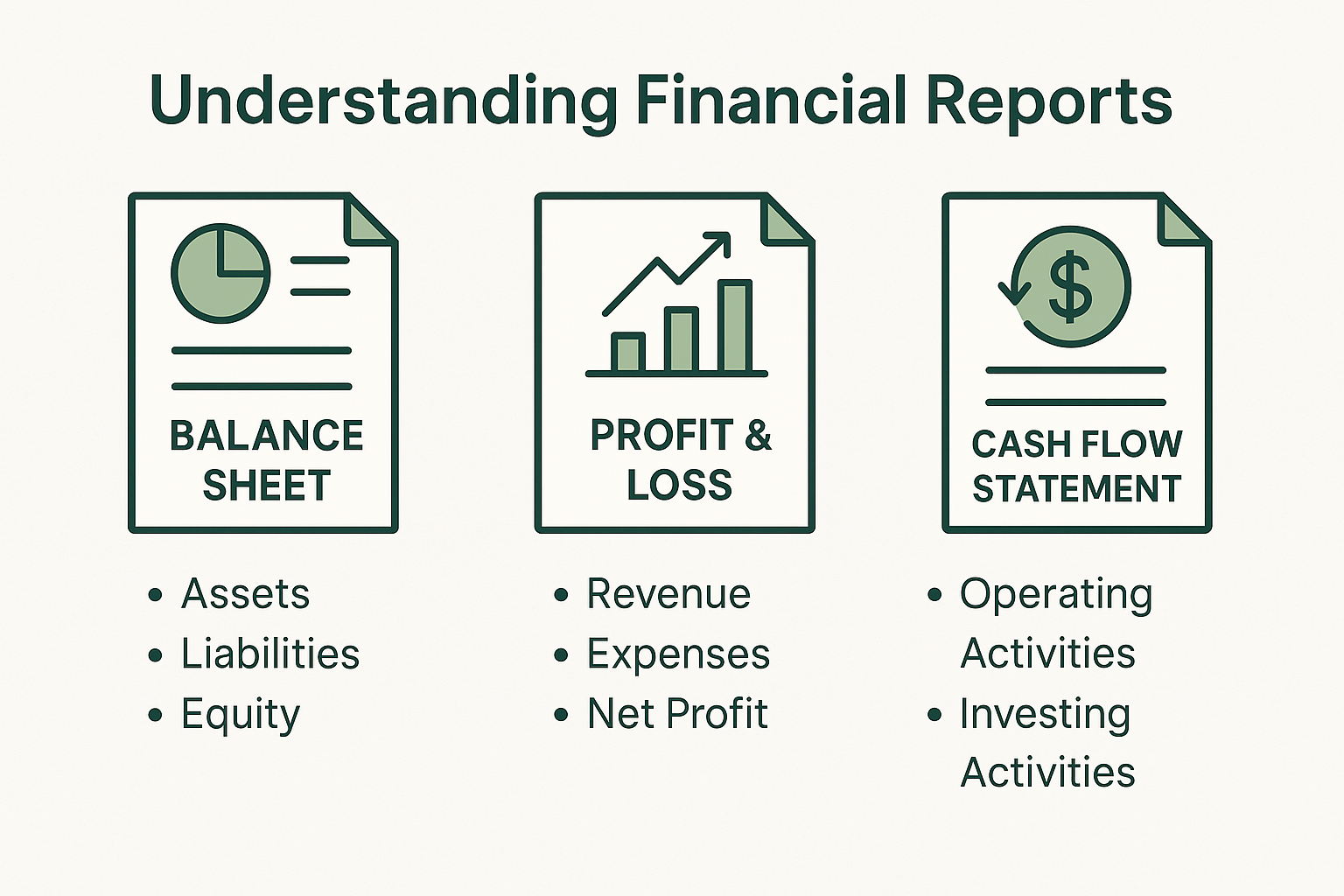

Lenders require a clear understanding of your business’s financial health before approving a loan. Accurate bookkeeping provides a detailed and transparent view of your financial situation. With well-maintained records, you can easily present up-to-date financial statements such as balance sheets, income statements, and cash flow statements. These documents demonstrate your business’s profitability, financial stability, and ability to manage cash flow—all key factors that lenders consider when evaluating a loan application.

2. Providing Credibility and Trust

When applying for a business loan, credibility is crucial. Lenders need to trust that the information you provide is accurate and reliable. Organized bookkeeping helps build this trust by ensuring that all financial data is consistent, complete, and free from errors. When your financial records are well-maintained and up-to-date, lenders are more likely to view your business as a credible and responsible borrower.

3. Simplifying the Application Process

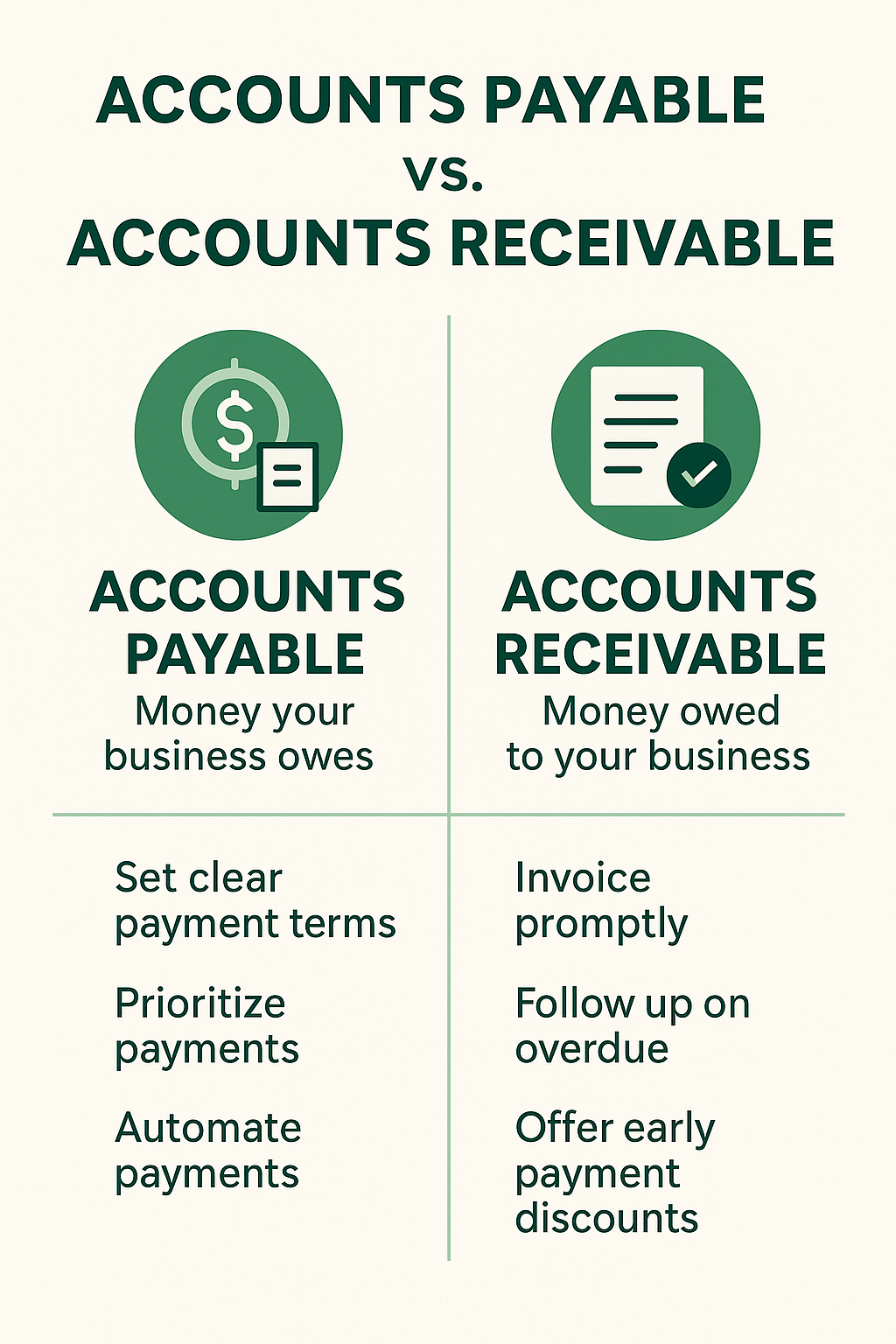

The process of applying for a business loan can be complex, requiring various financial documents and reports. With good bookkeeping practices, gathering these documents becomes much easier. You can quickly provide the necessary reports, including profit and loss statements, cash flow projections, and accounts receivable and payable reports. This not only speeds up the application process but also increases your chances of approval by presenting a well-organized and professional loan package.

4. Supporting Cash Flow Management

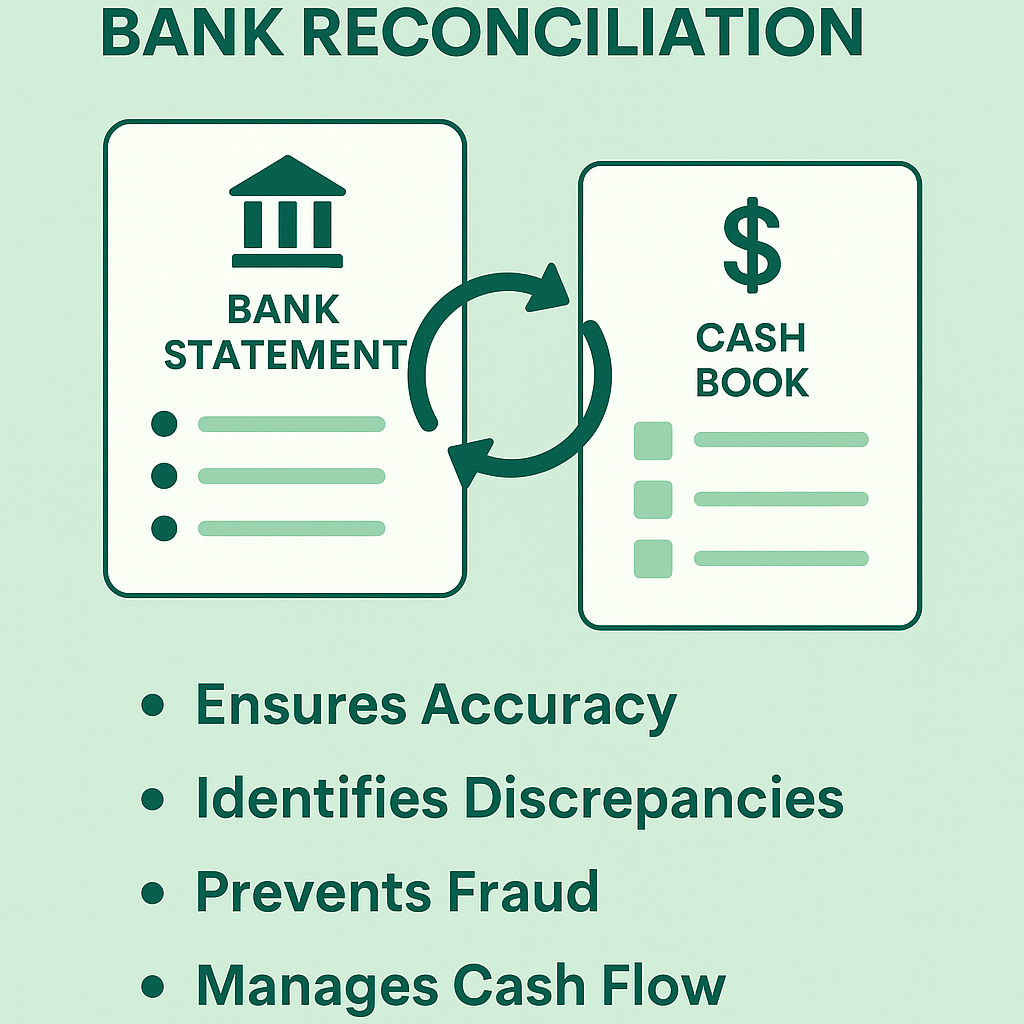

Cash flow is one of the most critical factors that lenders assess when considering a loan application. They want to ensure that your business generates enough cash to cover loan repayments in addition to your regular operating expenses. Effective bookkeeping allows you to monitor your cash flow closely and make necessary adjustments to maintain a healthy balance. By providing accurate cash flow statements, you can demonstrate to lenders that your business has the financial capacity to manage additional debt.

5. Preparing for Due Diligence

During the loan approval process, lenders often conduct a thorough due diligence review of your business. This review includes an in-depth analysis of your financial records to assess the risks associated with lending to your business. Proper bookkeeping ensures that all your financial records are organized, accurate, and readily available for review. This level of preparedness not only impresses lenders but also reduces the risk of delays or issues during the due diligence process.

6. Forecasting Future Performance

Lenders are not only interested in your current financial status but also in your future prospects. Accurate bookkeeping allows you to generate financial forecasts and projections based on historical data. These forecasts help lenders understand how you plan to use the loan and how it will impact your business’s growth and profitability. A well-prepared financial forecast can provide lenders with the confidence they need to approve your loan application.

7. Strengthening Loan Negotiations

When you have a solid understanding of your business’s financial position, you are in a stronger position to negotiate loan terms. Accurate bookkeeping provides you with the data needed to justify the loan amount, interest rate, and repayment terms that best suit your business needs. This can result in more favorable loan terms that support your long-term financial goals.

Conclusion

Bookkeeping plays a crucial role in securing business loans by providing lenders with the financial transparency and credibility they need to make informed decisions. By maintaining accurate and organized financial records, you can demonstrate your business’s financial health, simplify the loan application process, and improve your chances of securing the funding you need to grow your business.

If you need help with your bookkeeping or preparing for a loan application, our professional bookkeeping services are here to support you. We can help you maintain accurate financial records, generate the necessary reports, and ensure that you’re fully prepared to secure the business loan that will take your company to the next level. Contact us today to learn more about how we can assist you in achieving your business goals.