How Accurate Bookkeeping Can Help You Avoid a Tax Audit

How Accurate Bookkeeping Can Help You Avoid a Tax Audit

As a business owner, one of the last things you want to face is a tax audit. While audits are relatively rare, certain red flags can increase your chances of being audited by the IRS. One of the most effective ways to minimize that risk is to maintain accurate and organized bookkeeping. By staying on top of your financial records, you not only ensure that your business runs smoothly but also reduce the likelihood of triggering an audit. Here’s how accurate bookkeeping can help you avoid a tax audit:

1. Avoiding Errors in Tax Returns

Accurate bookkeeping ensures that all your financial data is correctly recorded, which is crucial when it’s time to file your taxes. Mistakes such as incorrect income reporting, overlooked deductions, or misclassified expenses can raise red flags with the IRS. By keeping your books accurate and up to date, you minimize the risk of errors that could lead to an audit.

2. Properly Tracking Deductions

Claiming business deductions is important for reducing your tax liability, but improper or excessive deductions can draw the attention of tax authorities. With accurate bookkeeping, you can confidently track all eligible expenses and ensure that deductions are properly documented and reasonable. This helps you avoid the risk of claiming ineligible or inflated deductions, which can prompt further investigation.

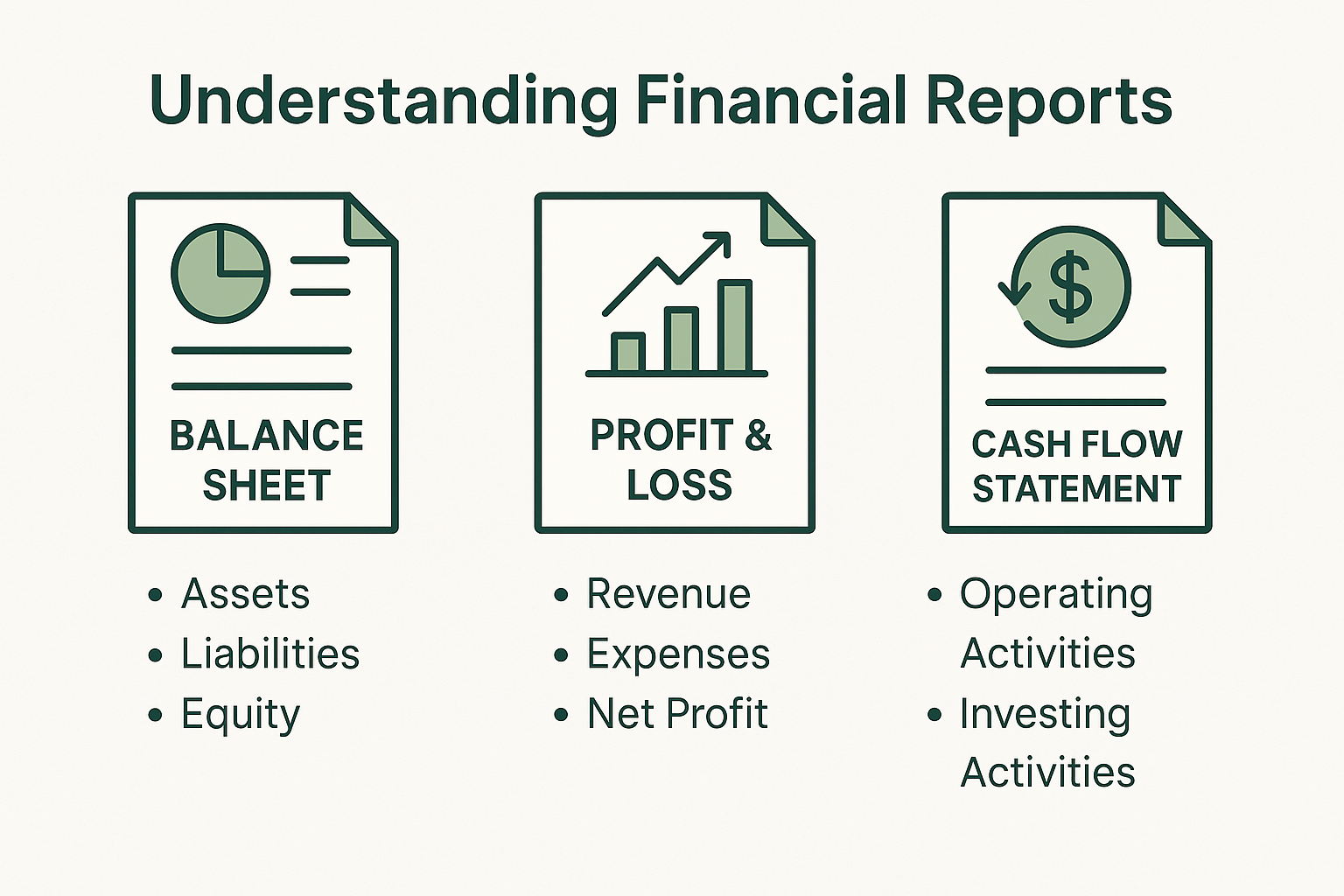

3. Maintaining Clear Records of Transactions

The IRS expects businesses to maintain detailed records of all transactions, including income, expenses, and payroll. If your bookkeeping is disorganized or incomplete, it may look suspicious. Having accurate, well-documented financial records shows that your business is transparent and compliant with tax regulations. In case of any questions or reviews by the IRS, clear records make it easier to verify the accuracy of your tax filings.

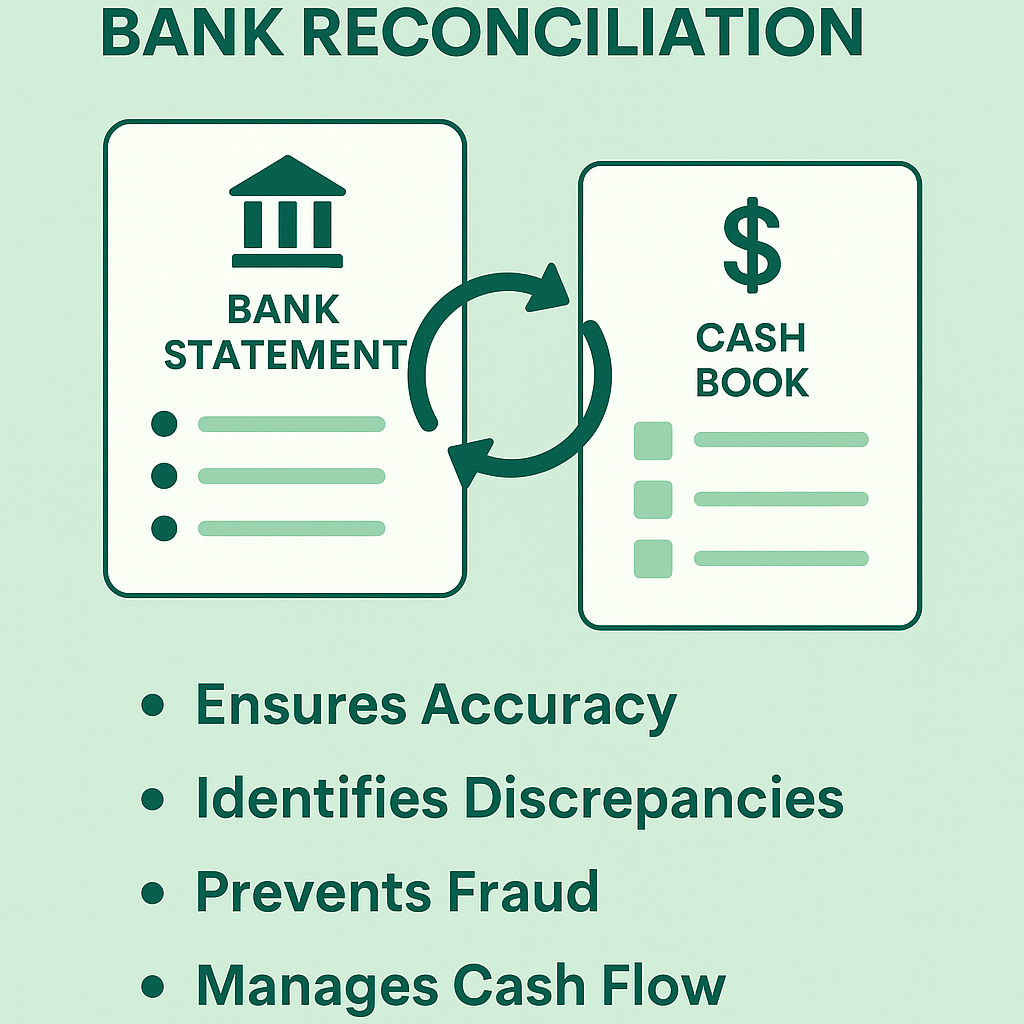

4. Preventing Cash Flow Discrepancies

Discrepancies between reported income and actual cash flow are a common reason for tax audits. For example, if your expenses seem disproportionately high compared to your income, it might raise concerns. Accurate bookkeeping helps you track income and expenses consistently, preventing any cash flow discrepancies that could appear suspicious to tax authorities.

5. Supporting Claims with Documentation

If you ever need to substantiate claims made on your tax return, such as deductions or credits, accurate bookkeeping is essential. Properly organized records of receipts, invoices, and other financial documents can support your claims and reduce the risk of a tax audit. Without these records, it’s harder to defend your tax position if it’s questioned.

Conclusion

Accurate bookkeeping is your first line of defense in avoiding a tax audit. By keeping your financial records well-organized and error-free, you can confidently file your taxes while minimizing the risk of attracting IRS scrutiny. If you need assistance with maintaining accurate bookkeeping or preparing for tax season, our professional services are here to help. Contact us today to ensure your business stays on track and audit-free!