The Financial Impact of Ignoring Your Books: Why Procrastination Costs More

The Financial Impact of Ignoring Your Books: Why Procrastination Costs More

As a business owner, you're often juggling many responsibilities. It's easy to let tasks like bookkeeping slip down your to-do list, but ignoring your financial records can lead to costly consequences. Procrastinating on your bookkeeping can cause significant financial strain, from missed payments and tax penalties to poor cash flow management. In this article, we'll explore the financial impact of ignoring your books and why procrastination can end up costing more in the long run.

1. Late Fees and Interest Charges

One of the immediate effects of neglecting your bookkeeping is the risk of late fees and interest charges on overdue bills. When you don't stay on top of your finances, it’s easy to miss payment deadlines, leading to penalties from suppliers, credit card companies, and lenders. These additional costs can accumulate over time, putting unnecessary strain on your cash flow and draining resources that could be better used elsewhere in your business.

2. Tax Penalties and Audits

Tax time can be particularly stressful if your financial records are disorganized or incomplete. Without accurate bookkeeping, it becomes challenging to file your taxes correctly and on time, increasing the risk of tax penalties, interest, or even an audit. The IRS and other tax authorities expect businesses to maintain detailed and accurate records, and failure to do so could result in fines or the need to pay back taxes. By procrastinating on your bookkeeping, you may end up paying far more in penalties than it would cost to maintain your books regularly.

3. Poor Cash Flow Management

Cash flow is the lifeblood of any business, and neglecting your books can make it nearly impossible to manage it effectively. Without up-to-date financial records, you lose visibility into how much money is coming in and going out of your business. This can lead to cash flow problems, such as overdrawing accounts, missing payroll, or not having enough funds for necessary expenses. By not addressing your books regularly, you’re putting your business at risk of running into cash flow crises that could have been easily avoided.

4. Missed Opportunities for Growth

When your financial records are not properly maintained, it’s difficult to identify opportunities for growth. You may miss out on applying for loans, securing investment, or taking advantage of new opportunities because your financial records are incomplete or disorganized. Lenders and investors want to see accurate, up-to-date financial statements before they commit, and procrastinating on your books could cause you to miss these growth opportunities.

5. Increased Stress and Time Pressure

Procrastinating on your bookkeeping can lead to increased stress and time pressure, especially when deadlines approach. If you've been neglecting your books for months or even longer, catching up can be an overwhelming task. Rushing to reconcile months of transactions, organize receipts, and ensure everything is in order can lead to errors and further financial complications. The longer you wait, the more stressful and time-consuming it becomes to catch up, impacting both your peace of mind and your business’s efficiency.

6. Higher Accounting Costs

When bookkeeping is neglected for an extended period, it often results in higher costs when you finally seek professional help to catch up. Accountants or bookkeepers may charge more to clean up months or years of disorganized records compared to maintaining them on a regular basis. Additionally, trying to fix errors from ignored bookkeeping takes longer and may lead to higher service fees, ultimately costing your business more than if you had kept up with your financial records regularly.

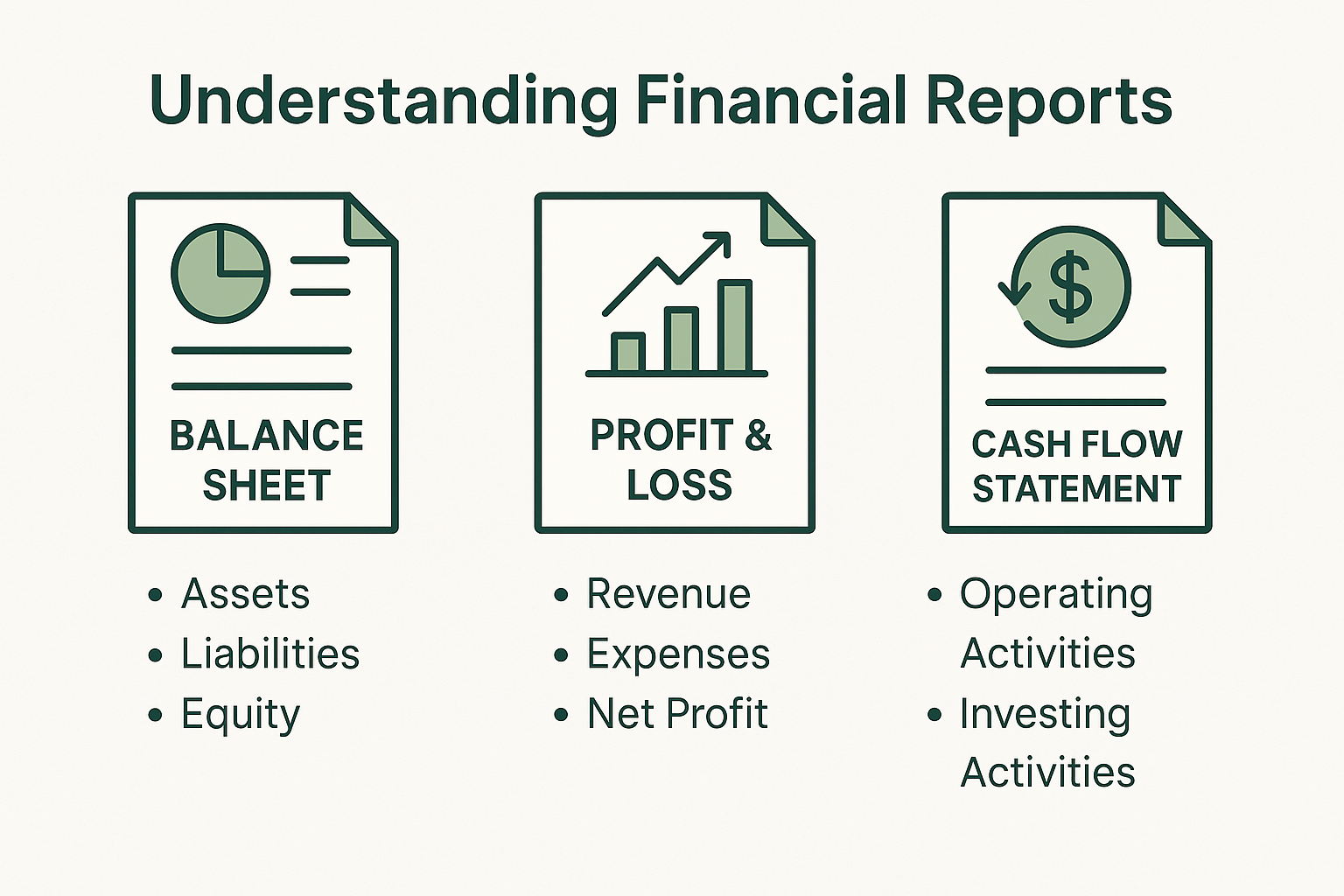

7. Inaccurate Financial Reporting

Accurate financial reports are critical for making informed business decisions. By ignoring your bookkeeping, you risk having inaccurate or incomplete financial statements, which can lead to poor decision-making. For example, you may not realize that certain expenses are eating into your profits or that a particular product line is underperforming. Without clear financial data, it’s nearly impossible to develop effective strategies for growth or cut back on inefficiencies, leading to lost profits and missed opportunities.

Conclusion

Procrastinating on your bookkeeping is not just an administrative oversight; it can have serious financial consequences for your business. From late fees and tax penalties to missed opportunities and cash flow problems, ignoring your books can end up costing you much more in the long run. By staying on top of your financial records, you can avoid these issues, make informed decisions, and keep your business on a path to success.

If bookkeeping feels overwhelming or time-consuming, consider outsourcing the task to a professional. Regular, accurate bookkeeping can save you money, reduce stress, and ensure that your business is always financially prepared. Contact us today to learn how our bookkeeping services can help you avoid the costly impact of procrastination and keep your business on track.