Why Accurate Financial Records Are Crucial for Business Growth

Why Accurate Financial Records Are Crucial for Business Growth

Accurate financial records are the backbone of any successful business. They provide a clear picture of your company’s financial health, helping you make informed decisions, plan for the future, and drive sustainable growth. Whether you're a small startup or a well-established corporation, maintaining precise and up-to-date financial records is essential for achieving your business goals. In this article, we’ll explore why accurate financial records are crucial for business growth and how they can impact your company’s success.

1. Informed Decision-Making

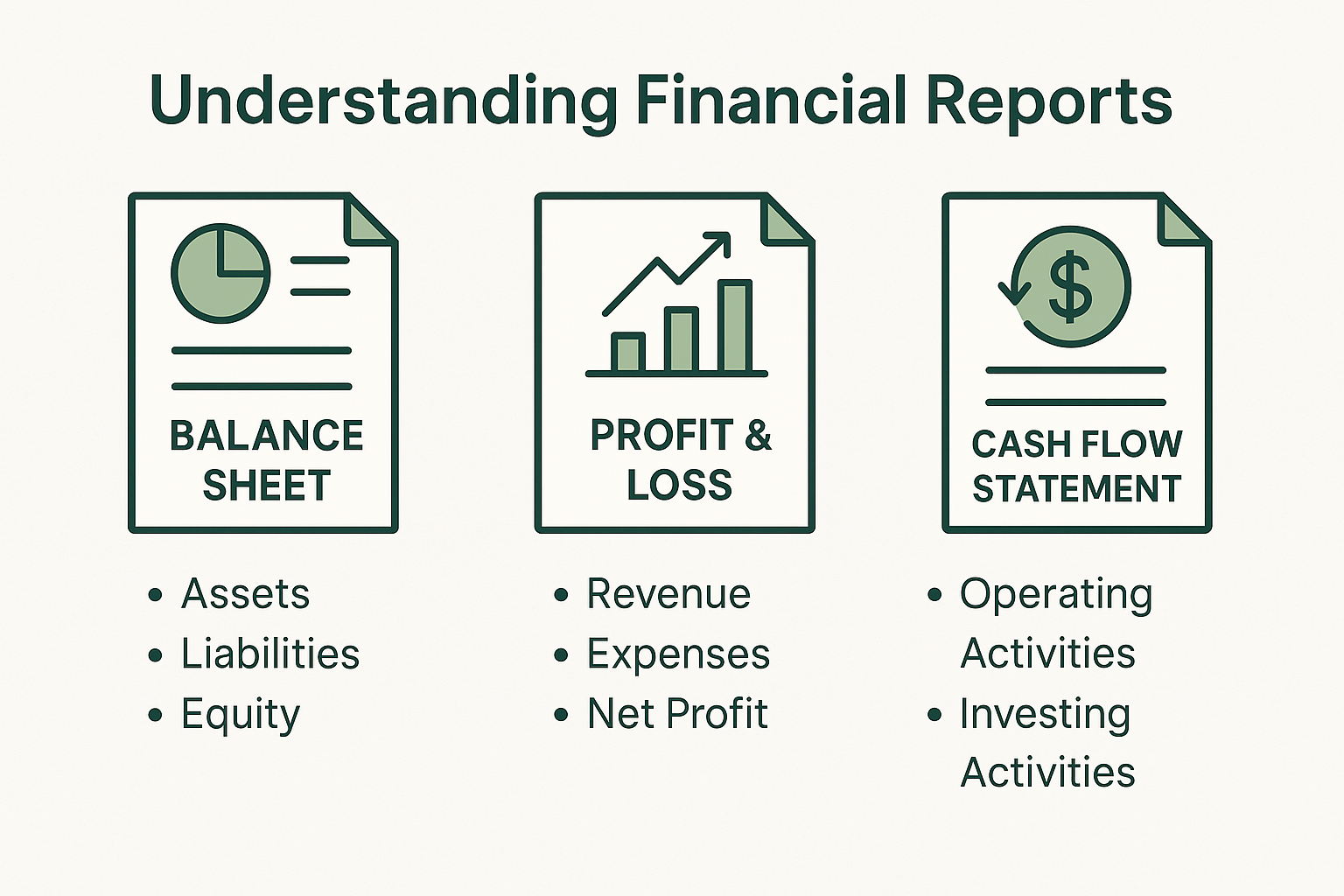

Accurate financial records allow you to understand your business's current financial status clearly. By regularly reviewing financial statements, such as balance sheets, income statements, and cash flow statements, you can assess your company’s performance, identify trends, and make informed decisions. Whether you’re considering expanding your business, investing in new equipment, or hiring additional staff, having accurate financial data ensures that your decisions are based on real, reliable information.

2. Effective Budgeting and Planning

Financial records play a crucial role in budgeting and planning for the future. By analyzing past financial data, you can create realistic budgets that reflect your business’s needs and goals. Accurate records help you anticipate future expenses, allocate resources effectively, and set achievable financial targets. This level of planning is essential for sustaining growth and avoiding financial pitfalls.

3. Improved Cash Flow Management

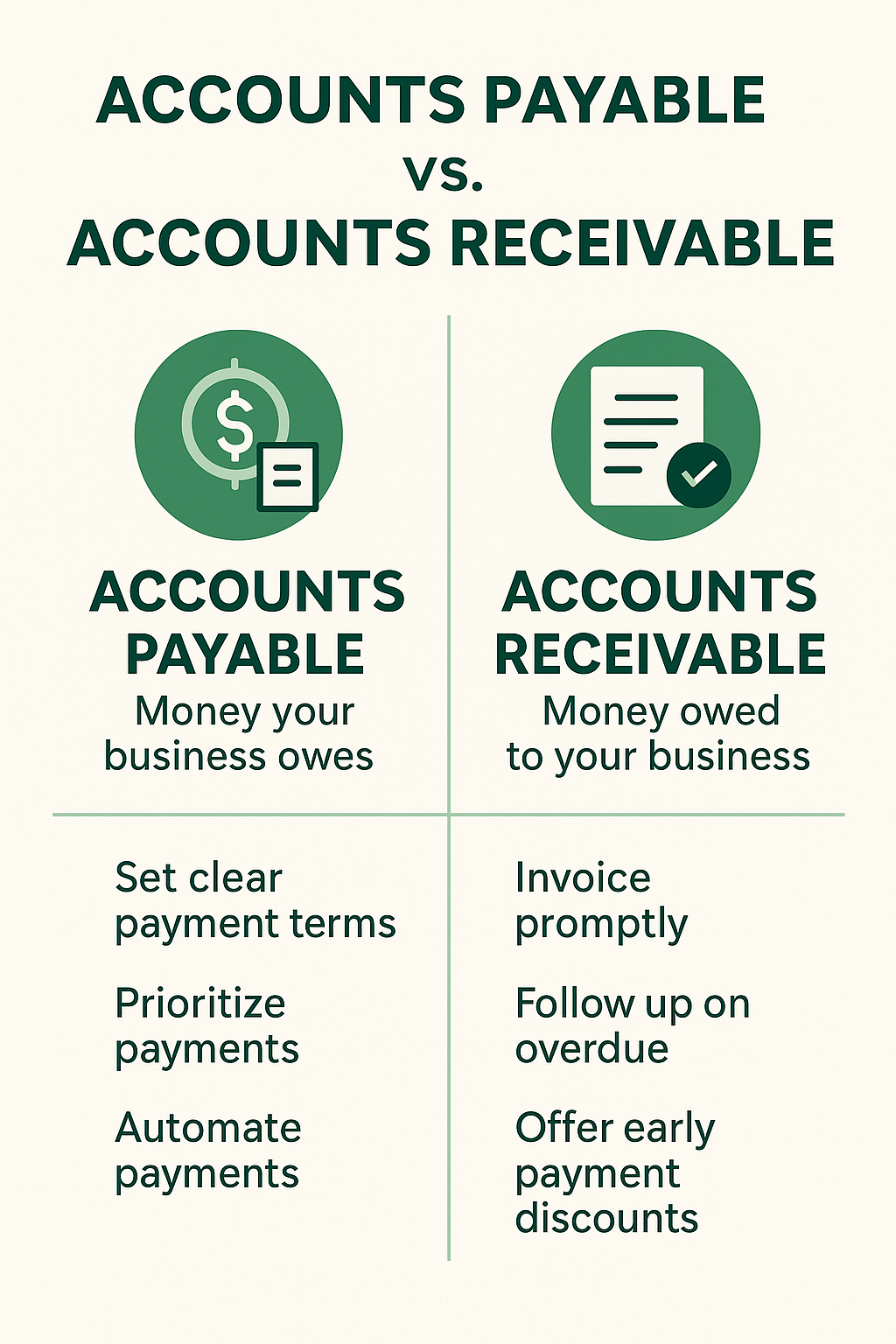

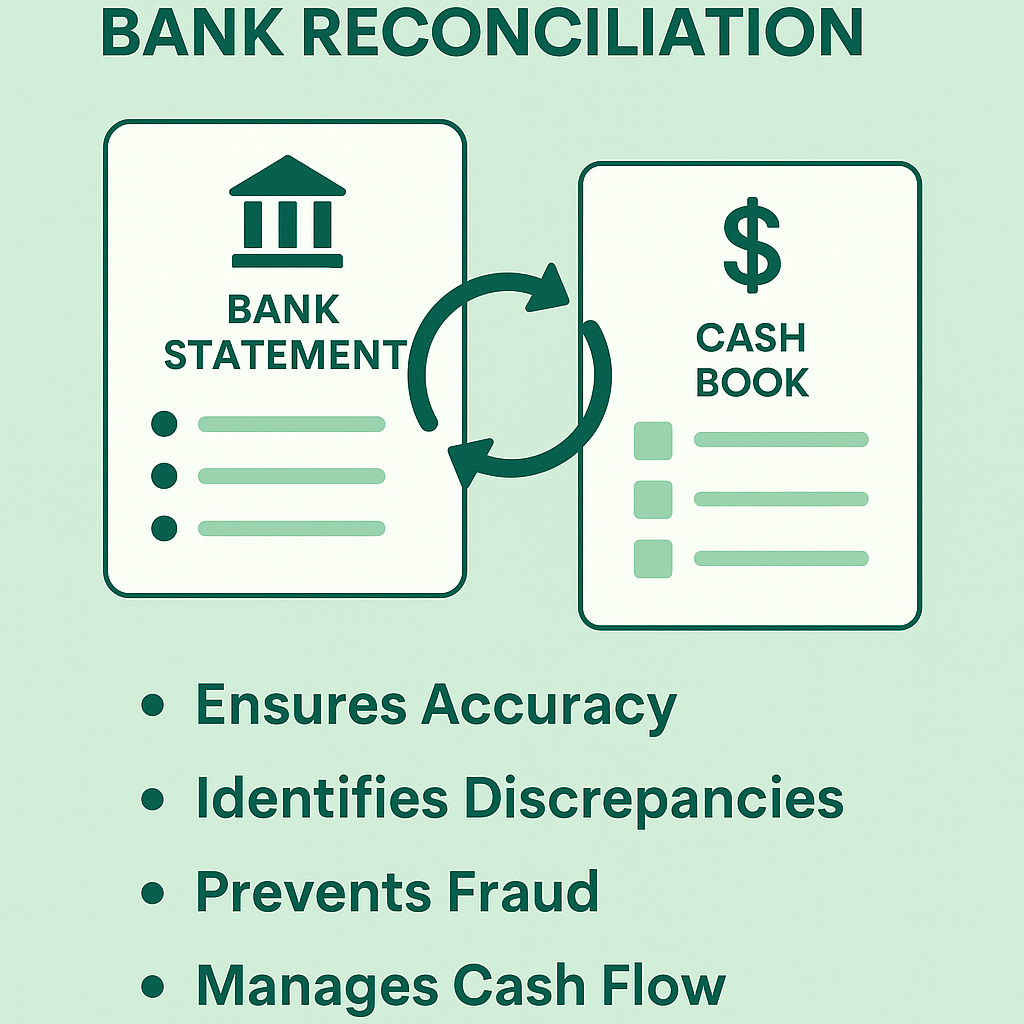

Cash flow is the lifeblood of any business, and accurate financial records are key to managing it effectively. By tracking your income and expenses closely, you can monitor your cash flow in real-time, ensuring that your business has enough funds to cover its obligations. Proper cash flow management helps you avoid cash shortages, make timely payments to suppliers, and invest in growth opportunities when they arise.

4. Easier Access to Financing

When seeking financing from banks or investors, accurate financial records are indispensable. Lenders and investors want to see that your business is financially sound and well-managed. Well-organized financial records demonstrate your business's profitability, stability, and potential for growth, making it easier to secure loans or attract investment. Without accurate records, you may struggle to prove your business’s worthiness to potential financiers.

5. Compliance and Legal Protection

Maintaining accurate financial records is not just a best practice; it’s also a legal requirement. Businesses are required to keep detailed financial records for tax reporting and compliance purposes. Inaccurate or incomplete records can lead to errors in tax filings, resulting in fines, penalties, or audits. Additionally, accurate records protect your business in case of legal disputes, providing clear documentation of financial transactions and obligations.

6. Enhanced Operational Efficiency

Accurate financial records contribute to the overall efficiency of your business operations. By keeping track of expenses, revenues, and other financial metrics, you can identify areas where your business may be overspending or underperforming. This insight allows you to make necessary adjustments, optimize your operations, and reduce unnecessary costs, ultimately leading to improved profitability and growth.

7. Better Stakeholder Communication

Accurate financial records are essential for transparent communication for businesses with multiple stakeholders, such as partners, investors, or board members. Regularly sharing financial reports ensures that all stakeholders are informed about the company’s performance and financial health. This transparency builds trust and aligns everyone’s efforts towards common business goals, fostering a collaborative environment that supports growth.

Conclusion

Accurate financial records are more than just numbers on a page—they are a powerful tool that can drive your business’s growth and success. From informed decision-making and effective budgeting to improved cash flow management and easier access to financing, maintaining precise and up-to-date financial records is critical for achieving your business goals. By prioritizing accuracy in your financial management, you set the foundation for sustainable growth and long-term success.

Investing time and resources in accurate bookkeeping and financial management pays off in the long run, helping you navigate the challenges of running a business and seize opportunities for growth. Whether you manage your records in-house or outsource to a professional bookkeeping service, ensuring accuracy should always be a top priority.