Top 10 Bookkeeping Tips for New Entrepreneurs

Top 10 Bookkeeping Tips for New Entrepreneurs

Starting a new business is an exciting journey, but it also comes with its fair share of challenges. One of the most crucial aspects of running a successful business is maintaining accurate financial records. Effective bookkeeping not only keeps your finances in order but also helps you make informed decisions, plan for the future, and stay compliant with tax laws. For new entrepreneurs, getting bookkeeping right from the start is essential. Here are the top 10 bookkeeping tips to help you manage your business finances efficiently.

1. Separate Personal and Business Finances

One of the first steps in setting up your business is to open a separate bank account for business transactions. Mixing personal and business finances can lead to confusion, inaccurate records, and potential tax issues. By keeping them separate, you’ll have a clearer view of your business’s financial health and avoid any complications during tax season.

2. Choose the Right Bookkeeping Software

Investing in reliable bookkeeping software is crucial for managing your finances effectively. Tools like QuickBooks Online, Xero, or FreshBooks offer features tailored for small businesses, such as automated invoicing, expense tracking, and financial reporting. These platforms also make it easy to collaborate with your accountant or bookkeeper, ensuring that your records are always up to date.

3. Track All Business Expenses

Keep detailed records of all business-related expenses. This includes everything from office supplies and travel expenses to marketing costs and professional services. Tracking your expenses not only helps you manage cash flow but also ensures you can claim all eligible deductions during tax season. Make it a habit to record expenses as they occur to avoid any last-minute rush.

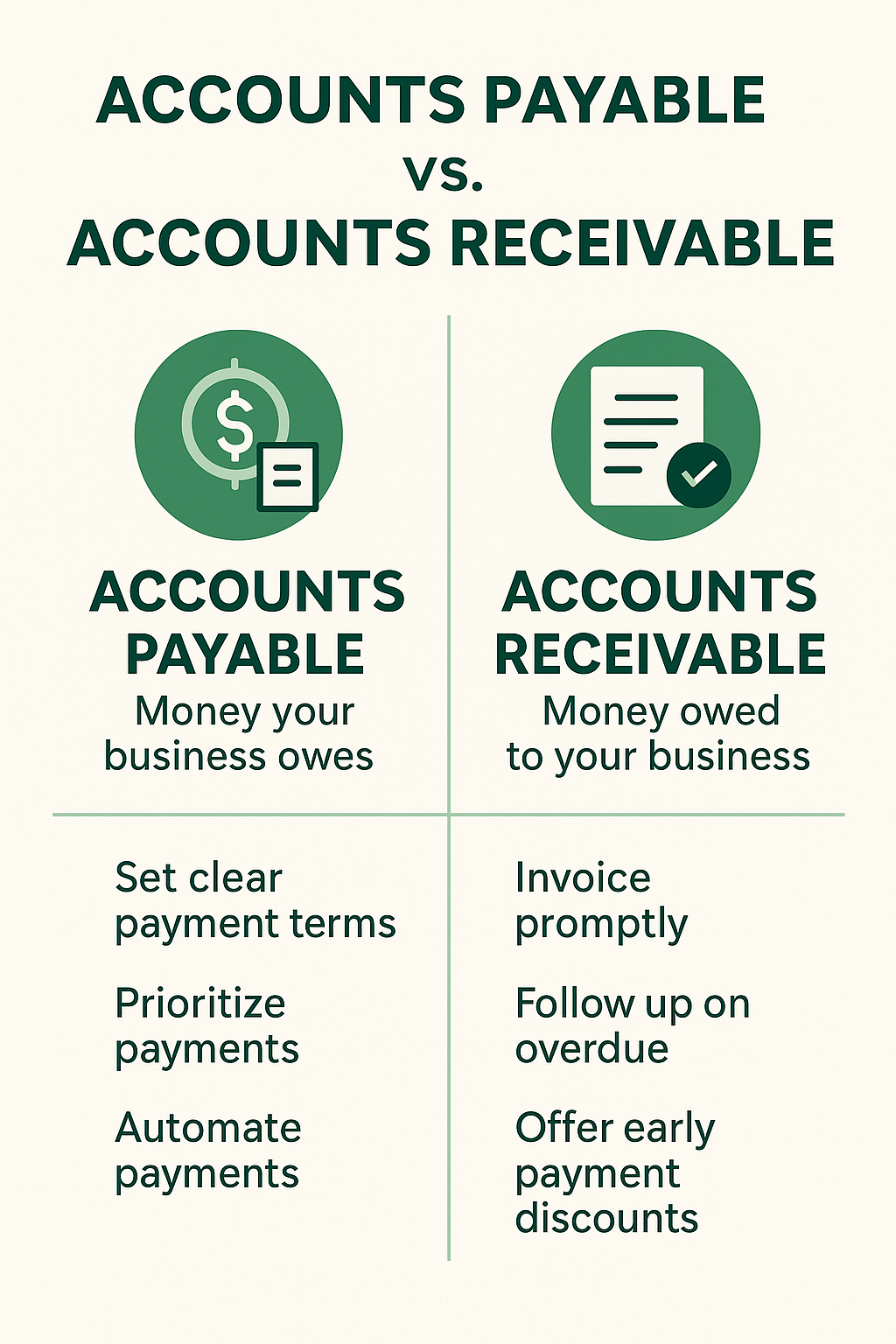

4. Stay on Top of Invoicing

Prompt and accurate invoicing is key to maintaining healthy cash flow. Make sure to send out invoices as soon as the work is completed and set clear payment terms. Using bookkeeping software to automate invoicing can save you time and help you keep track of outstanding payments. Regularly follow up on overdue invoices to avoid cash flow issues.

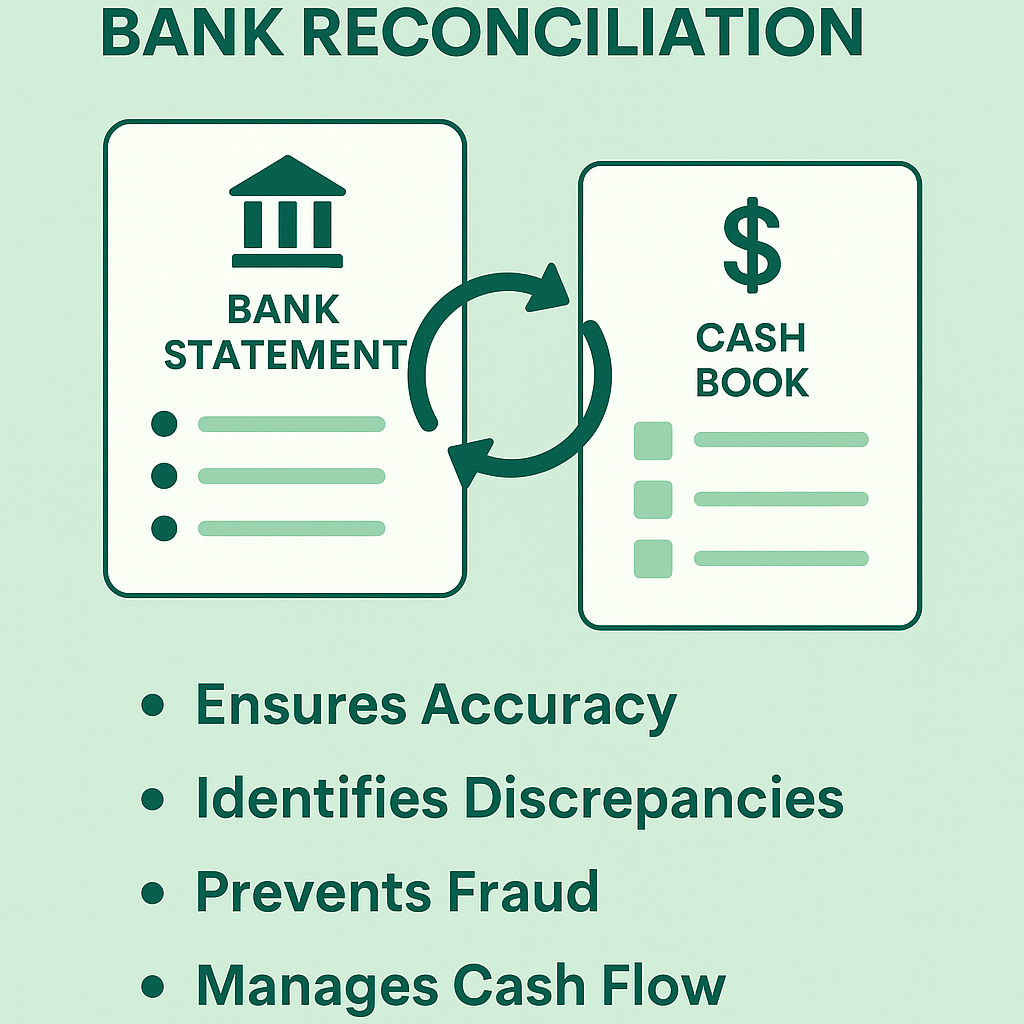

5. Reconcile Bank Accounts Regularly

Reconciling your bank accounts involves comparing your bookkeeping records with your bank statements to ensure they match. This process helps identify any discrepancies, such as missing transactions or errors. Regular reconciliations (at least once a month) are essential for maintaining accurate financial records and catching any potential issues early.

6. Keep Accurate Records of Receipts

Maintaining accurate records of all your receipts is important for both tax purposes and financial management. Consider using a digital system to scan and store receipts electronically. This not only saves physical space but also makes it easier to retrieve documents when needed. Most bookkeeping software integrates with receipt management apps, allowing you to attach receipts directly to your expense entries.

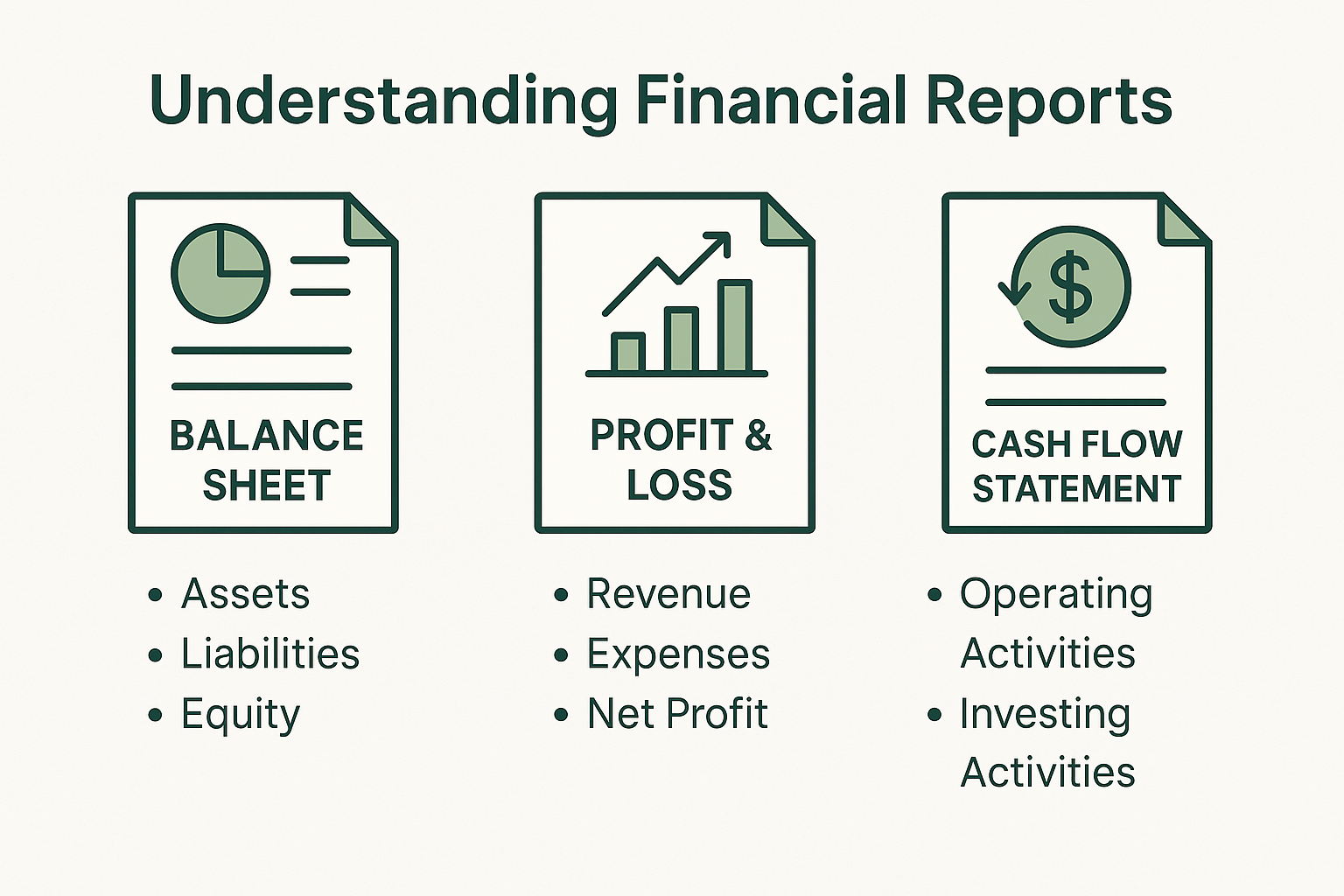

7. Monitor Your Cash Flow

Cash flow is the lifeblood of any business. Regularly monitor your cash flow to ensure that your business has enough funds to cover its expenses. A positive cash flow allows you to invest in growth opportunities, while a negative cash flow can lead to financial difficulties. Use your bookkeeping software to generate cash flow statements and analyze your financial situation.

8. Understand Your Tax Obligations

As a new entrepreneur, it’s crucial to understand your tax obligations. This includes knowing when to file taxes, what deductions you’re eligible for, and how much to set aside for tax payments. Staying informed about tax deadlines and regulations will help you avoid penalties and ensure that you remain compliant. Consider consulting with a tax professional to get personalized advice.

9. Plan for Major Expenses

Every business faces major expenses from time to time, such as equipment purchases, software upgrades, or marketing campaigns. Planning for these expenses in advance helps you manage your cash flow and avoid financial strain. Set aside funds regularly to create a reserve that can cover these costs when they arise.

10. Hire a Professional Bookkeeper

If bookkeeping isn’t your strong suit or if you find it taking up too much of your time, consider hiring a professional bookkeeper. A bookkeeper can manage your day-to-day financial transactions, reconcile accounts, and prepare reports, allowing you to focus on growing your business. Many bookkeepers offer virtual services, making it easy to find one that suits your needs and budget.

Conclusion

Effective bookkeeping is the foundation of a successful business. By implementing these top 10 bookkeeping tips, you’ll be well on your way to managing your business finances with confidence. Remember, staying organized, using the right tools, and seeking professional help when needed can save you time, reduce stress, and ultimately contribute to the long-term success of your business.

As you continue your entrepreneurial journey, keep these tips in mind and make bookkeeping a priority.

Your future self—and your business—will thank you!