Understanding Your Financial Statements: A Beginner's Guide

Understanding Your Financial Statements: A Beginner's Guide

As a business owner, understanding your financial statements is crucial for making informed decisions that drive growth, profitability, and sustainability. These documents provide insight into your business’s financial health and can guide your strategies for expansion, cost management, and even tax planning.

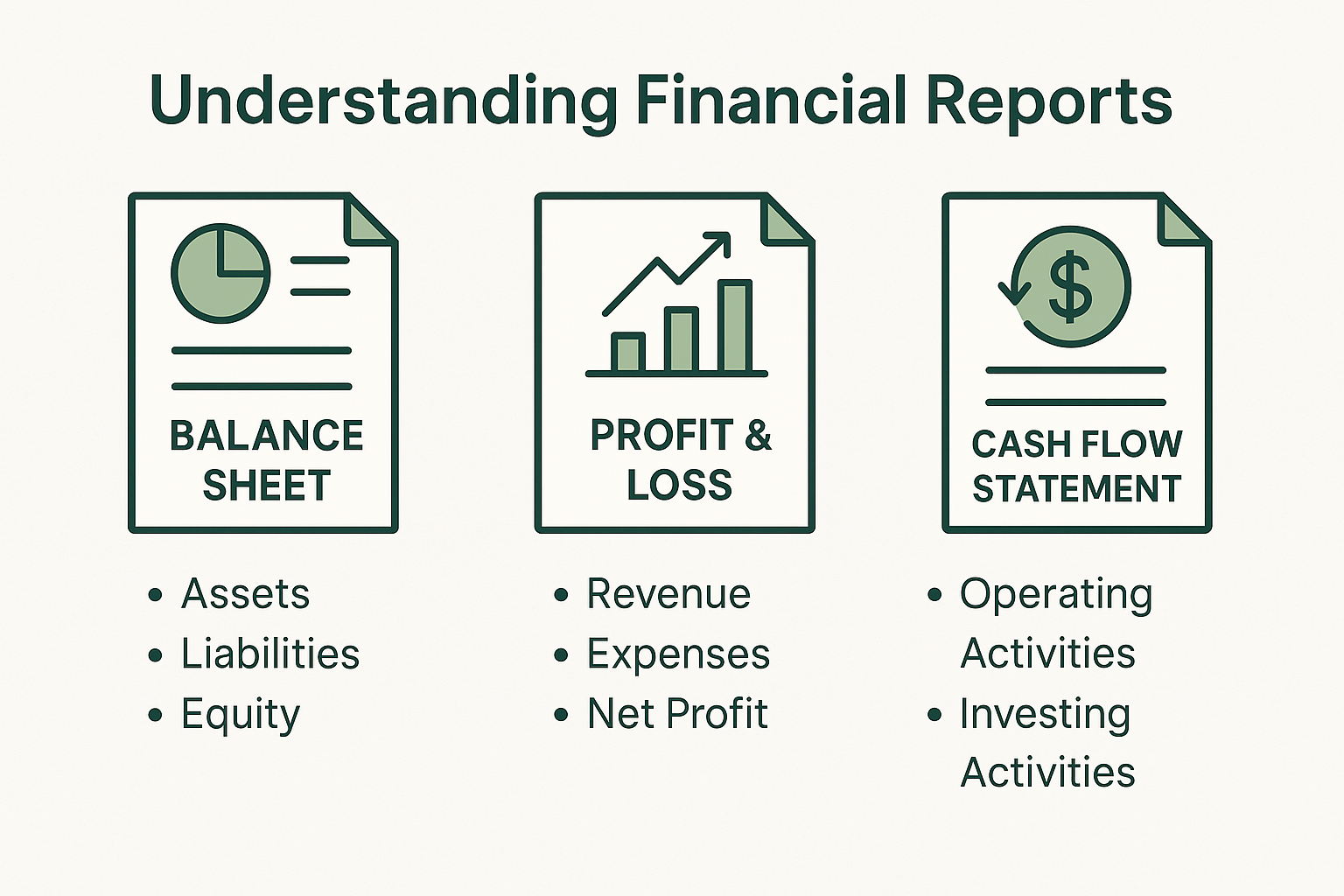

In this guide, we’ll break down the three most important financial statements: the Balance Sheet, Profit and Loss Statement (P&L), and Cash Flow Statement. By understanding these reports, you’ll be better equipped to manage your business’s finances and track your financial progress.

1. The Balance Sheet: A Snapshot of Your Business's Financial Position

The balance sheet provides a snapshot of your company’s financial position at a specific point in time. It lists everything your business owns (assets) and owes (liabilities), as well as the difference between the two, which is known as equity.

Key Components:

- Assets: These are everything your business owns that has value, such as cash, accounts receivable (money owed by customers), inventory, and property.

- Current Assets: Assets that are expected to be converted into cash within a year, like cash, accounts receivable, and inventory.

- Non-Current Assets: Long-term assets that are expected to be used for more than a year, like buildings, equipment, and land.

- Liabilities: These are your company’s debts or obligations, such as loans, accounts payable (money you owe to vendors), and accrued expenses.

- Current Liabilities: Debts that are due within a year, like short-term loans and accounts payable.

- Non-Current Liabilities: Long-term debts, such as long-term loans or bonds payable.

- Equity: This represents the owner’s stake in the business. It’s the difference between assets and liabilities and includes the owner’s investment and retained earnings.

Formula:

Assets = Liabilities + Equity

The balance sheet gives you a clear idea of your business's financial strength. If your assets exceed your liabilities, your business is in a strong position. If not, it may indicate financial challenges ahead.

2. The Profit and Loss Statement (P&L): Tracking Your Business’s Performance

The Profit and Loss Statement (P&L), also known as the income statement, shows how much money your business earned and spent over a specific period, typically monthly, quarterly, or annually. It tells you whether your business is making a profit or running at a loss.

Key Components:

- Revenue (Sales): This is the total amount of money your business earned from selling goods or services during the period.

- Cost of Goods Sold (COGS): This represents the direct costs of producing the goods or services sold by your business, such as raw materials, direct labor, and manufacturing costs.

- Gross Profit: This is the revenue minus the cost of goods sold. It shows how much money is left over after covering production costs.

- Formula: Gross Profit = Revenue - COGS

- Operating Expenses: These are the costs of running your business that are not directly tied to the production of goods or services, like rent, utilities, and salaries.

- Operating Profit (EBIT): This is the profit from your business's core operations before taxes and interest are deducted.

- Formula: Operating Profit = Gross Profit - Operating Expenses

- Net Income: This is the final profit or loss after all expenses, taxes, and interest have been deducted from your revenue. It represents your business’s overall profitability.

- Formula: Net Income = Revenue - Expenses (COGS + Operating Expenses + Taxes + Interest)

The P&L statement helps you understand if your business is profitable and where money is being spent. If your revenue is higher than your expenses, you’re making a profit. If your expenses outweigh your revenue, it’s time to reassess your spending.

3. The Cash Flow Statement: Understanding the Movement of Cash in Your Business

The Cash Flow Statement shows how cash moves in and out of your business over a specific period. Unlike the P&L statement, which records earnings and expenses on an accrual basis, the cash flow statement focuses purely on cash transactions. This is crucial because a business can be profitable on paper but still run into trouble if it doesn’t have enough cash on hand to cover its short-term obligations.

Key Components:

- Operating Activities: This section reflects the cash generated or spent from your business's day-to-day operations, such as cash received from customers and cash paid to suppliers.

- Investing Activities: This includes cash transactions related to the purchase or sale of assets, such as property, equipment, or investments.

- Financing Activities: This section displays cash movements related to borrowing, repaying debts, or raising capital through the issuance of stocks or the taking on of loans.

The cash flow statement helps you understand your liquidity — how much cash your business has available to meet its obligations. Positive cash flow means your business has more cash coming in than going out, while negative cash flow signals that your company may struggle to meet its financial obligations.

Conclusion: Why Understanding These Statements Matters

Understanding your Balance Sheet, Profit and Loss Statement, and Cash Flow Statement is essential for effective business management. These financial statements help you track your performance, spot potential issues early, and make data-driven decisions. Whether you’re managing cash flow, controlling costs, or planning for growth, these documents provide a clear picture of where your business stands financially.

If you’re feeling overwhelmed by these financial documents, don’t worry — I’m here to help! At Sihamkami Bookkeeping Services, we specialize in helping small businesses interpret and manage their financials. By leveraging the power of these financial statements, you can set your business on the path to success.

Feel free to reach out if you need assistance with your financial statements or QuickBooks Online setup!