The Role of Bookkeeping in Business Growth and Long-Term Financial Planning

The Role of Bookkeeping in Business Growth and Long-Term Financial Planning

As a small business owner, it’s easy to focus solely on the day-to-day tasks of running your company. Whether you’re managing operations, handling marketing, or providing customer service, the financial side can often take a backseat. However, consistent and accurate bookkeeping is essential not only for maintaining your business's financial health but also for fueling long-term growth and success.

At Sihamkami Bookkeeping Services, we understand the critical role bookkeeping plays in the trajectory of your business. Here’s how keeping accurate financial records can directly impact your company’s growth, funding opportunities, and long-term financial planning.

1. Financial Clarity Leads to Smarter Decision Making

Good bookkeeping offers more than just numbers—it provides you with the clarity to make informed decisions. By maintaining up-to-date financial records, you can quickly assess your business’s profitability, cash flow, and overall financial health. This insight allows you to:

- Identify trends: Recognize periods of high or low revenue, enabling you to adjust operations accordingly.

- Track expenses: Understand where your money is going and find opportunities to reduce unnecessary costs.

- Budget effectively: Set realistic financial goals and allocate resources efficiently to areas that drive business growth.

When you have clear financial data at your fingertips, you can make well-informed decisions that align with your long-term business goals.

2. Bookkeeping Supports Funding and Investment Opportunities

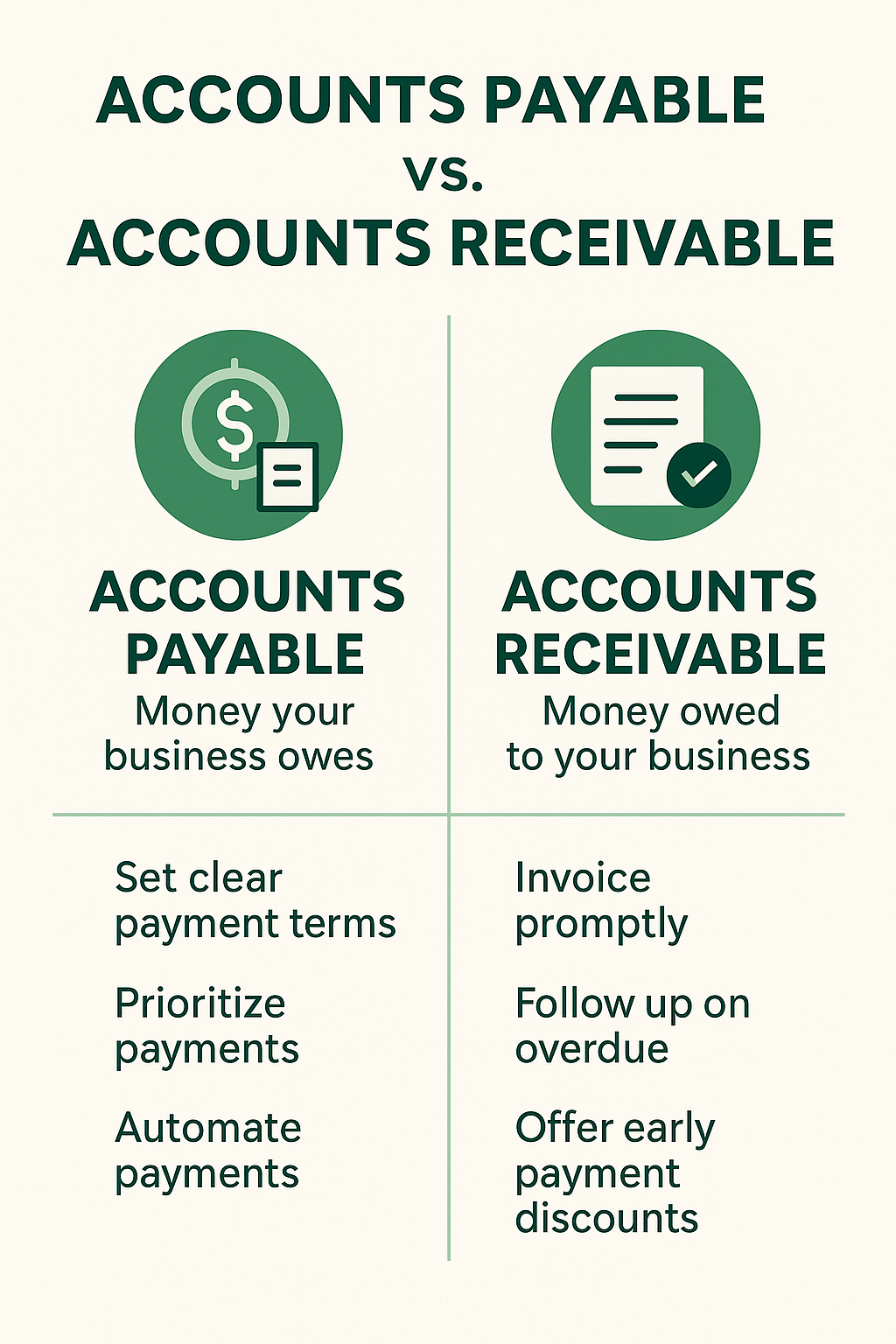

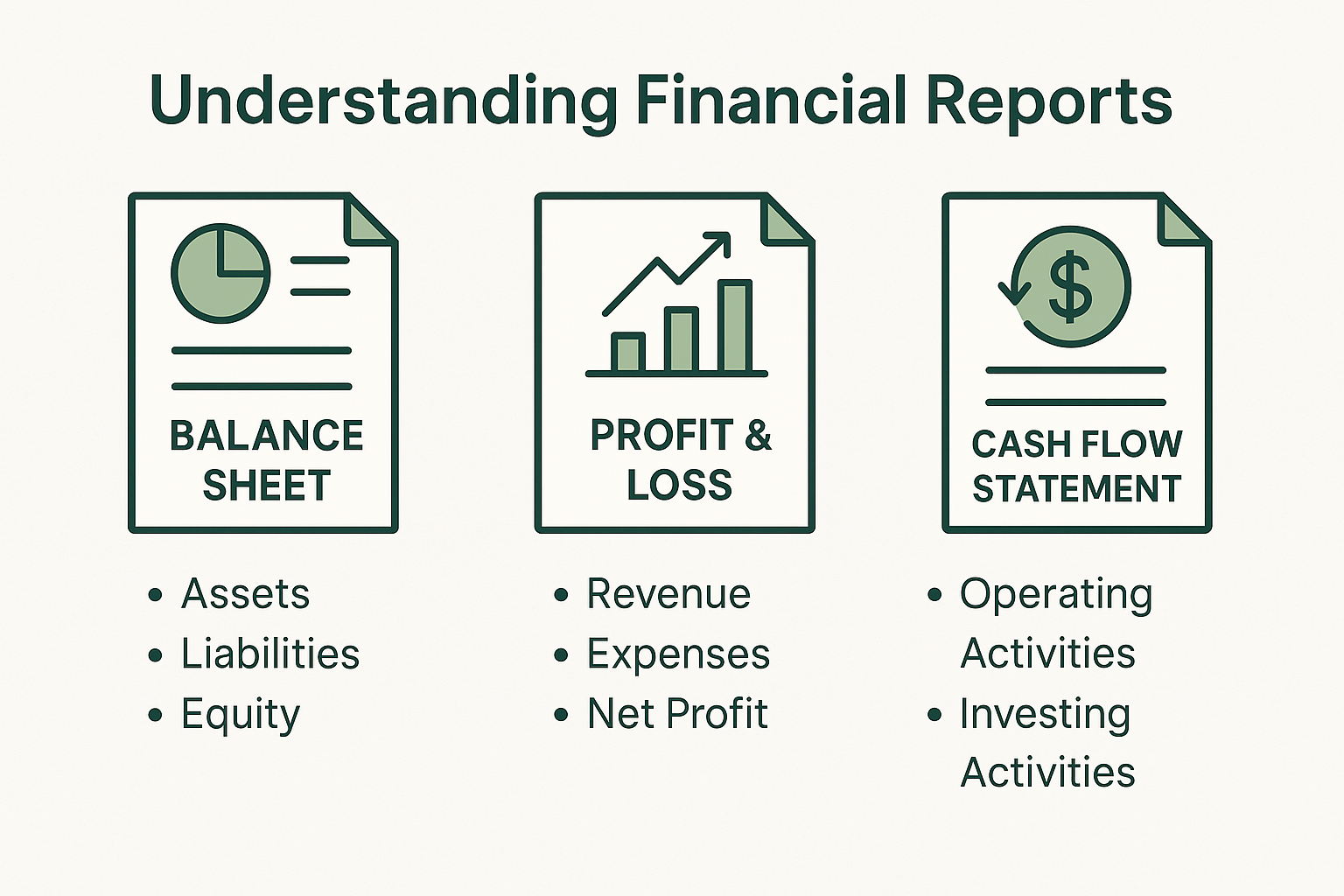

When it comes to securing funding or investment for your business, lenders and investors require concrete financial evidence. Accurate financial statements (such as profit and loss statements, balance sheets, and cash flow reports) are essential for:

- Loan applications: Banks and financial institutions will assess your business’s financial health before approving any loan. Proper bookkeeping ensures that your financials are in order, increasing the likelihood of loan approval.

- Attracting investors: Investors want to see a clear, organized, and profitable business model. Transparent financial records build trust and demonstrate that your business is a good investment.

- Grant eligibility: Many government grants and private funding programs require detailed financial reports to ensure that funds are being allocated appropriately.

Having organized financial records not only helps you secure the funds you need but also shows that you are a responsible business owner.

3. Scaling Your Business with Confidence

As your business grows, the financial complexities increase. Whether you’re hiring new employees, expanding to new locations, or launching additional products or services, bookkeeping becomes even more crucial. Here’s how it helps:

- Managing growth: Accurate financial data helps you determine when it’s the right time to invest in new opportunities and scale your operations without overextending yourself.

- Tax efficiency: A well-maintained bookkeeping system ensures that your business complies with tax regulations and helps you avoid costly errors, such as missing out on deductions or misreporting income.

- Forecasting and planning: Reliable records enable you to forecast future financial needs, so you can plan for expansions, renovations, or marketing campaigns that will support growth.

When it’s time to scale, your bookkeeping acts as a roadmap, helping you assess the risks and rewards of your decisions.

4. Long-Term Financial Health and Planning

The ultimate goal of bookkeeping is to ensure that your business remains financially stable over the long term. By consistently monitoring your finances, you can build a solid foundation for future growth, whether you’re planning to:

- Retire comfortably: Accurate bookkeeping enables you to track the value of your business and its growth over time, providing valuable insights into your future financial picture.

- Prepare for an exit strategy: If you plan to sell your business in the future, maintaining clean financial records will make the transition much smoother, attracting potential buyers with clear evidence of profitability.

- Plan for unforeseen expenses: Building an emergency fund and knowing when to set aside cash for potential downturns or unexpected expenses will ensure your business survives through challenging times.

By integrating bookkeeping into your long-term business strategy, you’re not just focusing on immediate profits but securing the future of your business.

Why Choose Sihamkami Bookkeeping Services?

At Sihamkami Bookkeeping Services, we specialize in helping business owners like you maintain clean and accurate financial records. Our bookkeeping services empower you to make smarter decisions, secure funding, scale your business, and plan for long-term success. Whether you’re just starting or looking to improve your current financial processes, we’re here to guide you every step of the way.

Contact us today to learn how we can help streamline your bookkeeping and set your business on the path to growth and financial success!