Common Bookkeeping Mistakes Small Businesses Make (And How to Avoid Them)

Common Bookkeeping Mistakes Small Businesses Make (And How to Avoid Them)

As a small business owner, managing your bookkeeping can sometimes feel overwhelming. It’s easy to make mistakes, especially when you're juggling various aspects of running your business. However, these mistakes can have long-term consequences that affect your financial health, tax filings, and business growth. At Sihamkami Bookkeeping Services, we help you avoid these common errors to ensure your finances are on track and your business is set up for success.

Here are some of the most frequent bookkeeping mistakes small businesses make—and how to avoid them.

1. Failing to Keep Personal and Business Finances Separate

One of the first mistakes many small business owners make is mixing personal and business finances. This can lead to confusion when it comes to tracking business expenses, and it can also cause issues come tax time.

How to Avoid This Mistake:

- Open a separate business bank account and use it exclusively for business-related transactions.

- Get a business credit card to keep your personal and business expenses apart.

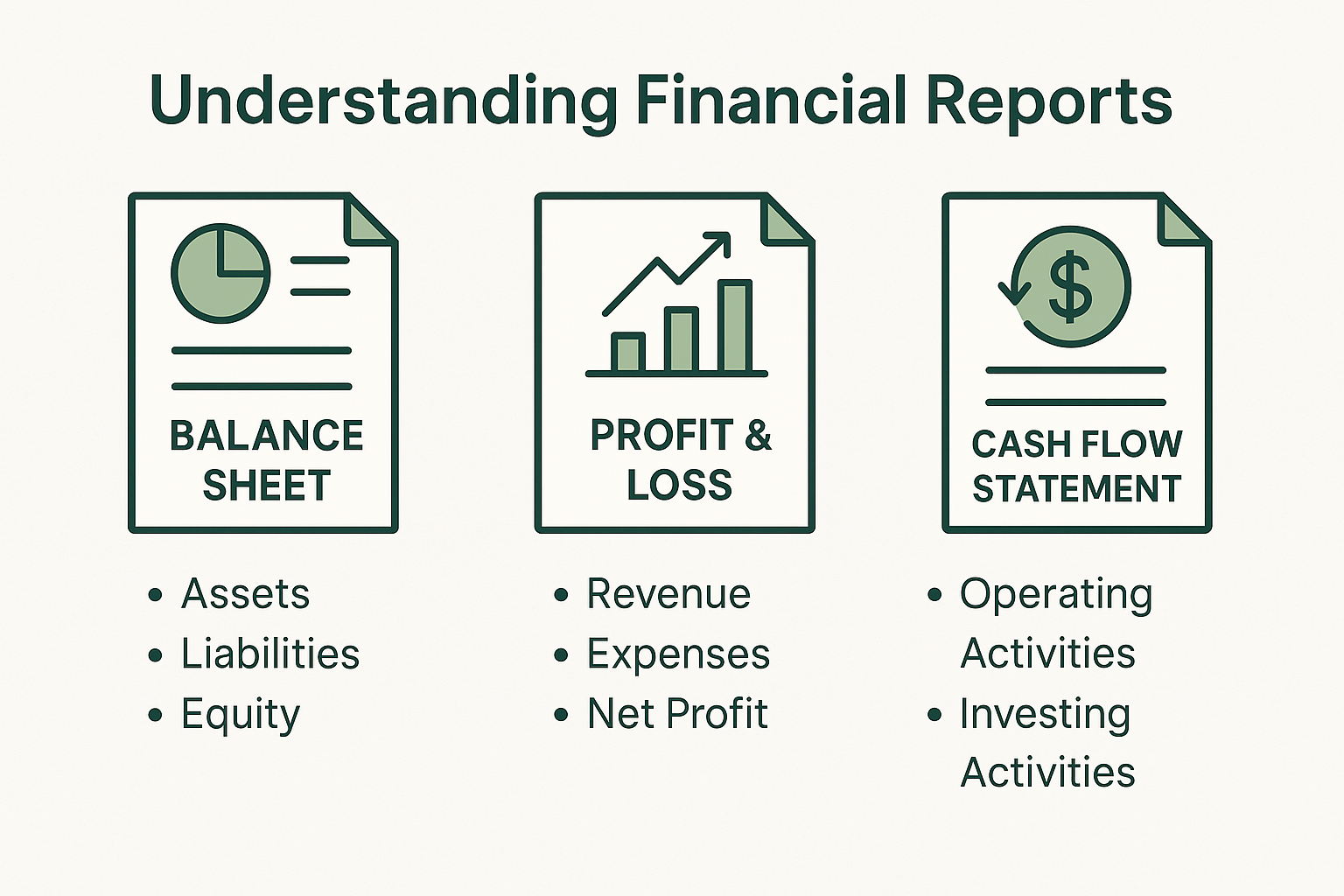

2. Not Keeping Accurate or Timely Records

Many small business owners are guilty of letting their bookkeeping fall behind. Without timely and accurate records, it becomes difficult to make informed decisions and keep track of cash flow.

How to Avoid This Mistake:

- Set aside time each week or month to update your financial records.

- Use bookkeeping software like QuickBooks or Xero to stay organized and streamline your process

.

3. Not Categorizing Expenses Correctly

Incorrectly categorizing expenses can lead to overpaying taxes, missing out on deductions, and causing confusion in financial reporting.

How to Avoid This Mistake:

- Categorize all expenses correctly from the start. Work with your bookkeeper to ensure that each expense falls under the appropriate category.

- Regularly review your categories to make sure they align with your business activities.

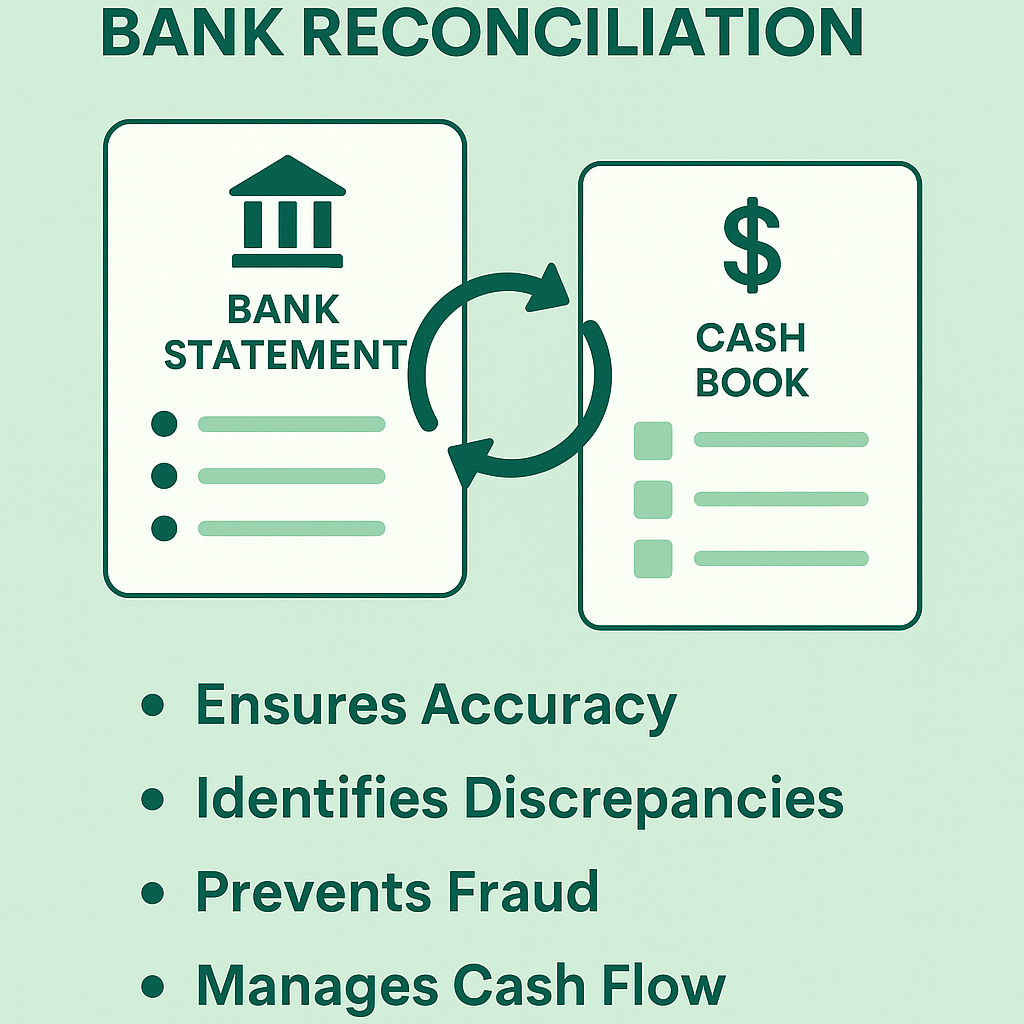

4. Ignoring the Importance of Reconciliation

Reconciliation ensures that the financial records in your accounting software match the statements from your bank and credit card accounts. Many small businesses skip this step, leading to errors in cash flow and inaccurate financial reporting.

How to Avoid This Mistake:

- Perform bank reconciliations monthly. If you're not sure how to do it, hire a professional bookkeeper to help you stay on top of it.

- Use automated reconciliation features available in accounting software.

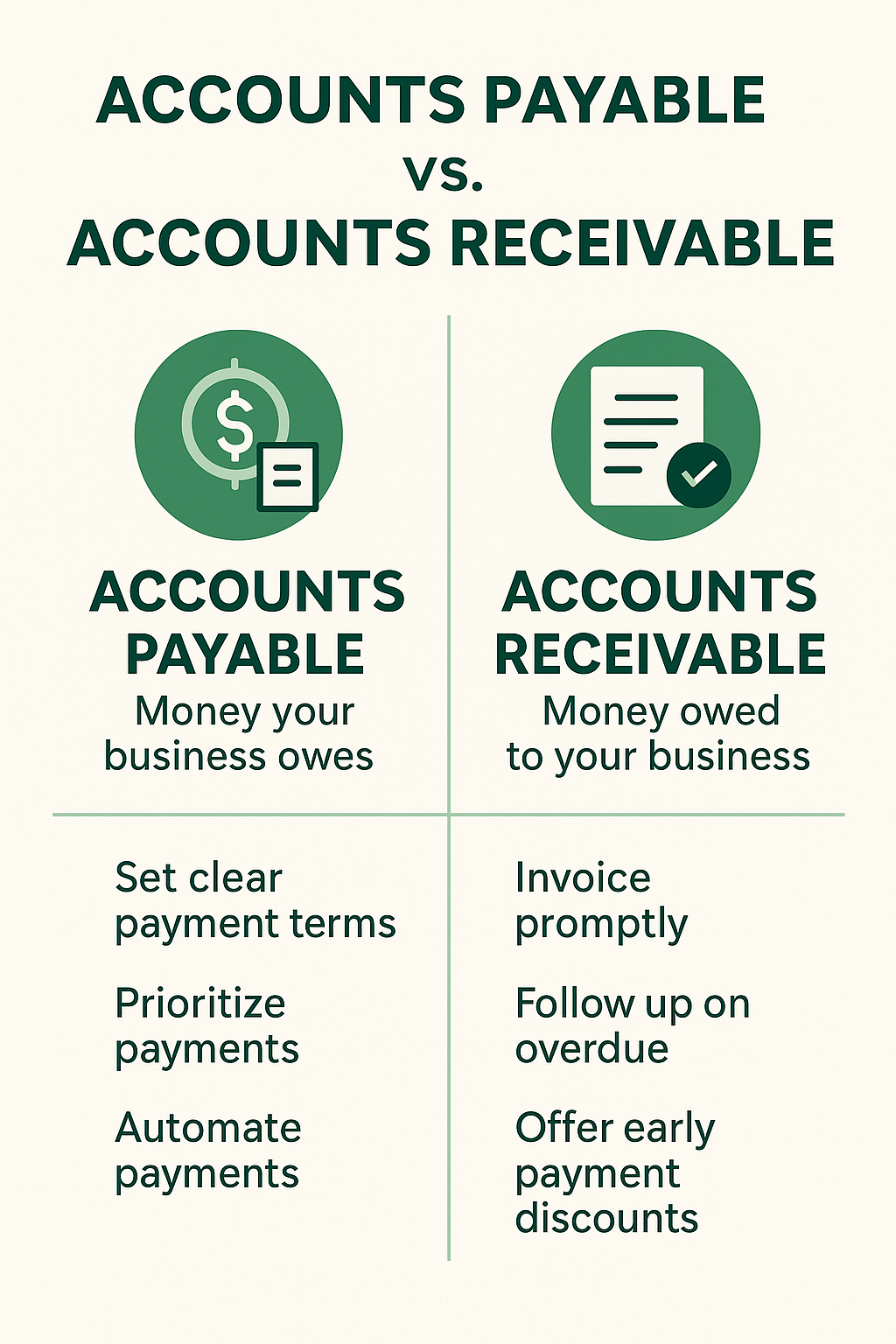

5. Not Keeping Track of Receivables and Payables

Failing to track your accounts receivable and accounts payable can create cash flow problems. Unpaid invoices and missed payments can lead to late fees and loss of income.

How to Avoid This Mistake:

- Use accounting software to track invoices and payments.

- Implement a solid invoicing and follow-up system to ensure timely payments.

6. Overlooking Tax Deadlines and Obligations

Missing tax deadlines is a costly mistake. Whether it’s sales tax, payroll tax, or income tax, failure to pay taxes on time can result in penalties and interest.

How to Avoid This Mistake:

- Keep track of key tax deadlines throughout the year.

- Hire a professional bookkeeper or accountant to ensure you're meeting your tax obligations on time.

7. Not Having an Emergency Fund or Financial Plan

Many small business owners focus so much on day-to-day operations that they fail to plan for the future. Not having an emergency fund or long-term financial plan can leave your business vulnerable during tough times.

How to Avoid This Mistake:

- Set aside a percentage of your profits into an emergency fund.

- Work with a financial planner to set long-term financial goals for your business.

Conclusion

Avoiding these common bookkeeping mistakes will not only save you money but also ensure that your business stays organized and compliant with tax laws. At

Sihamkami Bookkeeping Services, we specialize in helping small businesses stay on top of their financial records, giving you the time and confidence to focus on growing your business. Let us help you avoid these common mistakes and set you on the path to long-term success!