5 Common Bookkeeping Mistakes Small Businesses Make and How to Avoid Them

5 Common Bookkeeping Mistakes Small Businesses Make and How to Avoid Them

Effective bookkeeping is essential for the success of any small business. However, many entrepreneurs struggle with managing their books, leading to costly mistakes. In this post, we’ll discuss five common bookkeeping mistakes small businesses make and provide tips on how to avoid them.

1. Mixing Personal and Business Finances

Mistake: One of the most common mistakes small business owners make is mixing personal and business finances. This can lead to confusion, inaccurate financial records, and potential tax issues.

Solution: Open a separate bank account and credit card for your business. This will make tracking business expenses, managing cash flow, and preparing accurate financial statements easier. Regularly update your records to ensure all transactions are correctly categorized.

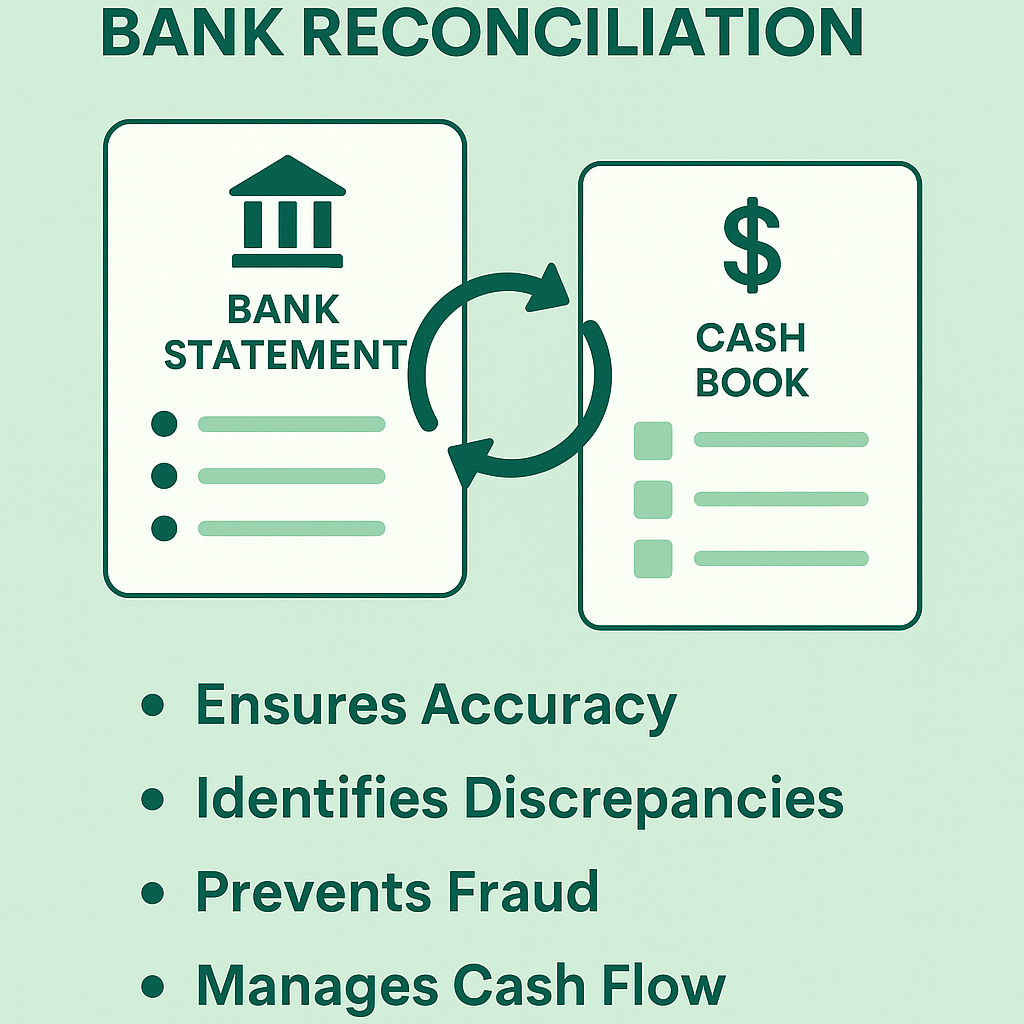

2. Neglecting to Reconcile Accounts

Mistake: Failing to regularly reconcile your bank and credit card statements with your bookkeeping records can result in discrepancies and undetected errors.

Solution: Schedule monthly reconciliations to compare your bank statements with your bookkeeping records. This helps identify and correct any discrepancies promptly, ensuring your financial data is accurate and up-to-date.

3. Not Keeping Receipts and Invoices

Mistake: Many small business owners neglect to keep receipts and invoices, making it difficult to verify transactions and claim deductions during tax season.

Solution: Implement a system for organizing and storing receipts and invoices. Use digital tools like receipt scanning apps to keep electronic copies, and categorize them by date and type of expense. This practice will streamline your bookkeeping process and support your tax filings.

4. Misclassifying Expenses

Mistake: Incorrectly categorizing expenses can lead to inaccurate financial reports and missed tax deductions.

Solution: Familiarize yourself with common expense categories and their definitions. Use accounting software to help automate the classification process and reduce errors. Regularly review your expense categories to ensure all transactions are correctly classified.

5. Delaying Bookkeeping Tasks

Mistake: Procrastinating on bookkeeping tasks can lead to a backlog of work, rushed entries, and errors in your financial records.

Solution: Set aside regular time each week to update your books. Consistent, timely bookkeeping helps maintain accurate records and reduces the risk of mistakes. Consider using bookkeeping software to streamline the process and save time.

How to Avoid Bookkeeping Mistakes: Best Practices

- Invest in Accounting Software: Utilize accounting software like QuickBooks, Xero, or FreshBooks to automate and streamline your bookkeeping processes.

- Hire a Professional: If managing your books becomes overwhelming, consider hiring a professional bookkeeper or accountant. They can ensure your financial records are accurate and up-to-date.

- Stay Educated: Keep up with the latest bookkeeping practices and tax regulations. Attend workshops, webinars, or courses to enhance your knowledge and skills.

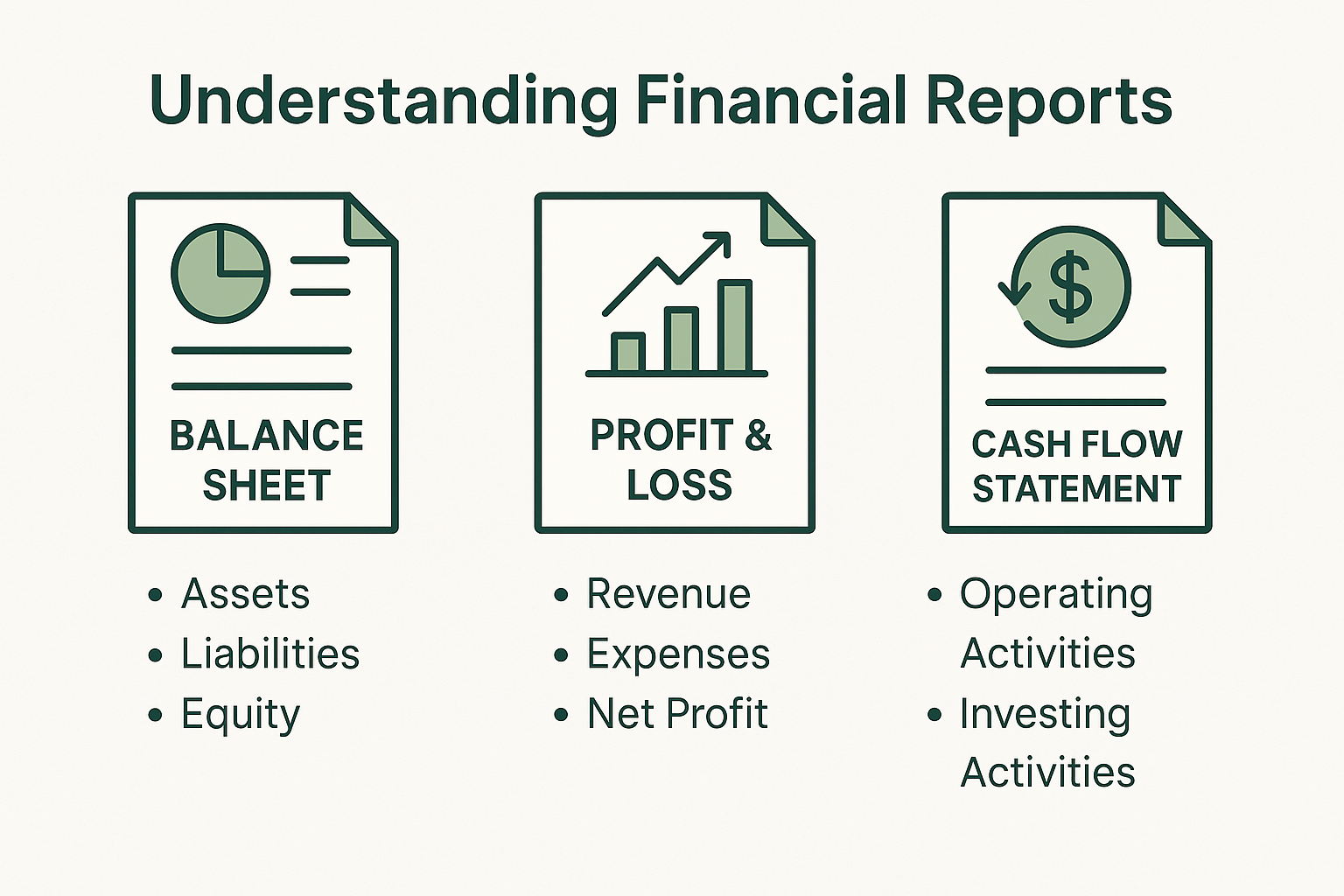

- Review Regularly: Regularly review your financial statements, including the income statement, balance sheet, and cash flow statement. This helps you stay informed about your business's financial health and make informed decisions.

Conclusion

Avoiding these common bookkeeping mistakes can save your small business time, money, and stress. By implementing the solutions and best practices outlined above, you’ll be well on your way to maintaining accurate and organized financial records. Remember, effective bookkeeping is the foundation of a successful business.

By staying on top of your bookkeeping tasks and avoiding these common pitfalls, you can ensure your small business's financial health and success.